India gearing up to make battery cells, leveraging the ACC-PLI

For India to effectively start mass production of battery cells indigenously, leveraging the benefits of the PLI scheme for ACC manufacturing, raw materials availability, and developing a sustainable value chain will be of utmost importance writes Dev Ashish Aneja and Abhishek Bansal, Invest India

Before delving into the raw material ecosystem of Li-ion batteries in India, let's take a step back to understand the materials that go into these batteries.

- Lithium

- Cobalt

- Nickel

- Manganese

- Aluminum

- Graphite

The most important among them is lithium. Ions of lithium flow from one electrode to another during each charge-discharge cycle of the battery. Most of the other metals mentioned above including cobalt and nickel can be avoided in certain chemistries such as the fast-growing LFP chemistry or the proprietary BM-LMP chemistry.

In Li-ion batteries, metals such as cobalt, nickel, aluminum, and manganese are added to lithium to enhance the battery's energy density and life (cycle life). Among all of these metals, cobalt is one of the most expensive metals. There is a global consensus on reducing or altogether eliminating cobalt content from batteries because of its geographic concentration in the Democratic Republic of Congo (65 percent of the world's cobalt), questionable mining practices, use of child labor, and price volatility. Cobalt production has increased many folds from ~27,000 MT in the late 1990s to ~150,000 MT in the recent past.

The problem with nickel lies in its refinement, a process that is cheaper in Asia than in North America and Europe.

Let us take a detailed look at each of these raw materials.

Lithium

In 1999, about 15,000 MT of lithium ore was mined internationally and this number has risen to over 85,000 MT in the recent past. The global market for alkali metal lithium is growing rapidly. Lithium has applications not only in Electric Vehicles but also in batteries of laptops, cell phones as well as glass and ceramics industry.

Chile, Argentina, and Bolivia - all in the Americas - account for more than 50 percent of the world's proven Lithium reserves. It's the unofficial Lithium triangle of the world. Yet, Australia mines most of the lithium worldwide, as shown in Figure 1.

Lithium from Australia comes from ore mining, while in Chile and Argentina lithium comes from salt deserts, so-called salars. However, there are general complaints about the extraction of lithium from salars. Since lithium mining is a water-intensive process, in some areas, locals complain about increasing droughts, which for example threatens livestock farming or leads to vegetation drying out.

Nickel

Nickel production in the past two decades has almost tripled from almost 1million tons to ~3 million tons. This is the main ingredient responsible for enhancing the energy density of batteries, especially used in performance vehicles. About 65 percent of nickel is concentrated in three countries namely, Indonesia, the Philippines, and Russia, with Indonesia and the Philippines cumulatively accounting for ~50 percent of the world's nickel.

Cobalt

Cobalt will remain a vital component in the manufacture of rechargeable batteries for the foreseeable future. A single nation accounts for more than half of the world's cobalt reserves. Many EV manufacturers have been trying to reduce the proportion of cobalt used in batteries because of its high cost and child labor issues in Congo. However, for companies focusing on long-range EVs (350 Km+) on one charge, cobalt must be used.

While cobalt has the potential to transform the Democratic Republic of the Congo (DRC) economically, its production throws up a big ethical dilemma: DRC has been consistently ranked as one of the world's most corrupt countries. It is estimated that up to 200,000 artisanal miners in the country work with their bare hands and with shovels down mines of up to 30m in length to extract the ore.

Manganese

Manganese (Mg) is the 12th most abundant element in the earth's crust. It occurs in many minerals such as manganite, purpurite, rhodonite, rhodochrosite, and pyrolusite. Manganese is mostly extracted from open pits and then transferred to a processing plant where it is treated. The steel industry is responsible for as much as 90 percent of manganese consumption.

The most important non-metallurgical application of manganese is in disposable and rechargeable batteries. It is preferred in cathode chemistries in the LIB because it offers energy density, power output, thermal stability, faster charging time, and shelf life. More recently manganese is increasingly being used in making cathode materials in NMC Li-ion batteries.

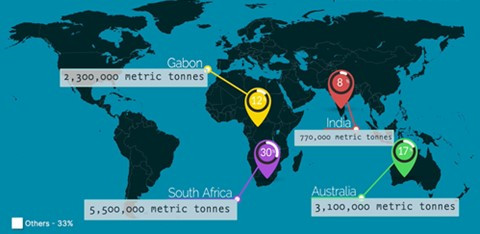

It is believed that about 74 percent of Mg reserves globally are found in South Africa. Mining has grown by 2.5X in the past two decades from 7.3 Mn MT to 18 Mn MT. What is interesting to note here is that about 8 percent of global mining (enough for India's needs) is happening in India – refer Figure 2.

Graphite

Graphite is the main raw material in the anode (which is between 10 - 15 percent) of the battery cell value. Graphite production has been steadily increasing over the past two decades from 700K MT to about 1 Mn MT. Synthetic graphite is used to make battery-grade electrodes due to their high purity. However, in recent years, some companies have started using natural graphite as well for battery-grade electrodes due to the high demand for LIBs. The world's 6 percent of graphite is produced in India as shown in Figure 3.

Aluminium

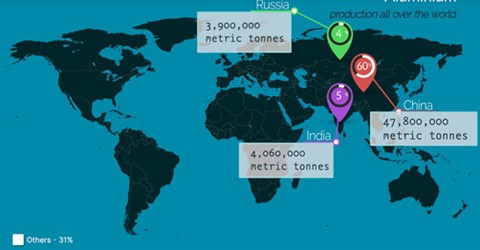

Aluminum is the third most abundant element in the earth's crust, refined from a specific ore called bauxite. Over 5 percent of global aluminum production happens in India as seen in Figure 4.

Indian context

Of the six major raw materials mentioned earlier, which go in battery cells, all are available in India, to some extent at least, barring nickel and cobalt.

Lithium: So far, Karnataka has a confirmed first lithium reserve with a 1,600-ton capacity. The power trading company Manikaran Power is behind an upcoming refinery in Gujarat for lithium, where it aims to produce 20,000 TPA of lithium, in carbonate form.

Graphite: India's graphite occurrences are found in States like Jammu and Kashmir, Gujarat, Jharkhand, Arunachal Pradesh, Karnataka, Kerala, Maharashtra, Tamil Nadu, Odisha, Chhattisgarh, and Rajasthan. However, the deposits that can be of economic significance are found in Andhra Pradesh, Chhattisgarh, and Arunachal Pradesh. Some of these fields are yet to be explored. As far as graphite mining and processing is concerned, Jharkhand, Odisha, and Tamil Nadu are the major States where mining is being undertaken. Lately, graphite mining has begun in Arunachal Pradesh as well.

With 35 percent of India's graphite deposits being found in Arunachal Pradesh, the State could now be developed as a leading producer of graphite in the country, thus helping in meeting its future needs.

Manganese: This ore is mined in India by opencast as well as by underground methods. India is a leading producer of manganese in the world (8 percent of global production). Madhya Pradesh, Odisha, Maharashtra, Karnataka, Goa, Jharkhand, Andhra Pradesh, Rajasthan and Gujarat are major manganese deposit states.

Based on the raw material availability and the consumer spending analysis, India needs a 2-pronged strategy:

1. Use nickel-based chemistries for performance vehicles

2. Use LFP batteries for economy vehicles

Similar guidance has been presented by the likes of VW, and recently Stellantis and Tesla too.

High-performance e-2W will most likely need NMC batteries. However, the Indian market is majorly dominated by price-conscious buyers of 2W's and 3W's. LFP is well suited for these vehicles because it is cheaper and there is limited price volatility impact of cobalt, nickel. Additionally, LFP batteries work well for India from a localization perspective as well. Most of the ingredients required for LFP cells are available in India. Even if lithium is imported – it is not more than 5-7 percent by value in a Li-ion cell.

Similarly, for anode (which is made out of graphite), thanks to the well-established steel industry in the country, we have enough raw material (coal tar) available. Firms like Epsilon Advanced Materials have announced plans to cater to 10 percent of global anode demand by 2030 sourcing coal tar from JSW Steel.

What we need in India is a decent enough performance vehicle at a low enough price point. And using LFP batteries is the way to go. It's already being done by benchmark players like Gogoro.

Hence, while it may seem on the surface that India doesn't have the necessary ingredients to make localization of Li-ion battery cells successful, the reality is a little different. India is well equipped to localize these batteries in the country leveraging the recently notified PLI ACC scheme.