Energy storage: consolidating a green sustainable world

The majority of the countries are making a shift to green and sustainable sources of energy, and storage is key to this energy transition, both on the grid and in transportation. To balance the irregularities between supply and demand, there has been an increase in the forms of energy storage throughout the world and the storage market has grown. Following is a glimpse into the energy storage development and deployment scenario around the world, compiled by Team ETN.

Global battery energy storage is expected to reach $11.04bn in 2025, with the market increasing by close to $5bn. Power sector transformation amid concerns over climate change, the uncertainty of fuel prices, and suitable policy decisions have supported the increased use of renewable energy across the world.

The increasing share of intermittent RE sources like solar and wind in the conventional energy mix will make balancing the system more difficult. The purpose of the RE integration is to reduce fossil fuel-generated electricity. Here, use energy storage becomes imperative to be able to provide a stable, uninterrupted power supply at all times.

According to BloombergNEF, by 2025, an increase of more than 300 percent in installed capacity globally is expected to reach ~1,769 GWh. China will continue to lead the market (with a share of ~63 percent), Europe will be second with a share of ~15 percent (representing a capacity of ~265 GWh), with the USA being third with a total share moving to ~9 percent, with an estimated capacity of almost 159 GWh.

The push towards e-mobility to reduce harmful tailpipe emissions has seen the growth of batteries for EVs the world over. In battery storage, Li-ion is the fast-growing technology that, according to research analysts, is expected to account for 85 percent of newly installed energy capacity in the world. Reports show that the global Li-ion battery market was valued at $30,186.8 million in 2017, and is projected to reach $100,433.7 million by 2025, growing at a CAGR of 17.1 percent from 2018 to 2025.

A look at global energy storage development:

EUROPE:

Europe's annual energy storage market is expected to grow to 3 GWh in 202, almost double from 1.7 GWh in 2020, according to a report by the European Association for Storage of Energy (EASE) and Delta-EE. Energy storage capacity across all segments is projected to grow from 3GW (exclusive of pumped hydro) to 26GW in 2030 and 89GW by 2040.

Batteries are a crucial element in the EU's transition to a climate-neutral economy, considering their contribution in initiating zero-emission mobility and the storage of intermittent renewable energy. The EU could account for 17 percent of the global battery demand, which is expected to increase by 14 times by 2030. It is forecasted that the battery market could be worth €250 billion/ year by 2025.

The proposal for a regulation on batteries and waste batteries adopted in December 2020, is all set to modernize the EU legislation on batteries to ensure the sustainability and competitiveness of the value chains. The proposal is part of the European Green Deal and related initiatives, including the new circular economy action plan and the new industrial strategy.

The European Commission wants to make the EU a pioneer in the use of hydrogen as an energy carrier. From 2020 to 2024, Europe aims the installation at least 6GW of renewable hydrogen electrolyzers in the European Union, and the production of up to one million tons of renewable hydrogen. Then from 2025 to 2030, hydrogen will become an intrinsic part of the EU's integrated energy system, with at least 40GW of renewable hydrogen electrolyzers and the production of up to ten million tons of renewable hydrogen in the EU. Finally, from 2030 to 2050, renewable hydrogen technologies should reach maturity and be deployed on a large scale across all hard-to-decarbonize sectors.

Europe is investing billions of dollars into research in an attempt to overturn Asia's dominance of the battery market. In 2019, the European Commission approved €3.2 billion of State funding under its 'important project of common European interest' (IPCEI) rules. The investment will support battery research and innovation across Belgium, Finland, France, Germany, Italy, Poland, and Sweden.

RUSSIA:

Energy storage is a top priority for everyone active in RE, and Russia is no exception. The Kremlin has plans to derive 4.5 percent of electricity from renewable sources by 2024, which means 5.5GW of renewables capacity and ESS to offset the intermittency of wind and solar energy generation.

Russia's biggest electricity provider and supplier of nuclear fuel for power plants - Rosatom (State Atomic Energy Corporation), has opened an energy storage business unit called RENERA to develop and trade module-type lithium-ion traction batteries. In addition to EV industry segments, the company will focus on energy storage systems for applications including emergency power supply, renewable energy, and smoothing load demand on the grid.

The combined effect of today's low-cost electricity generation via photovoltaic modules, water, and wind turbines and similarly low-cost storage in Li-ion battery and solar hydrogen obtained via water electrolysis will have a profound impact on Russia's energy and automotive industries. In early June 2020, Russia issued its Energy Strategy to 2035, which brings attention to the development of hydrogen energy.

UNITED KINGDOM:

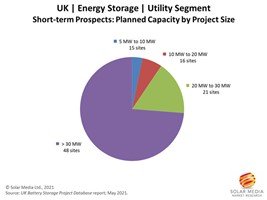

UK Battery Storage Project Database report discloses that approximately 300MW of utility-scale battery storage was deployed in 2019, bringing cumulative installations to over 900 MW at the end of the year. The UK government has announced that it will relax planning legislation, to make it easier to construct large batteries to store renewable energy from solar and wind farms across the country.

The pipeline for utility-scale battery storage in the UK has been continually increasing and is now over 20GW across more than 800 projects, implying that the next few years could show a major increase in energy storage deployment.

While the pipeline contains a mix of project sizes, the capacity is becoming increasingly dominated by large-scale projects. The energy storage market is becoming increasingly dominated by standalone sites as they get larger in capacity; 82 percent of the total planned capacity is from standalone.

Notable projects:

- The Minety 100MW project in Wiltshire, England, is currently the largest battery energy storage system (BESS) in Europe.

- Siemens and Britishvolt are setting up UK's first Li-ion battery Giga factory in Northumberland. With a production capacity of 35 GWh, it is expected to start delivery by end of 2023.

- Highview Power and Carlton Power JV will build and operate the world's first commercial liquid-air energy storage facility in Carrington. The 50 MW / 250 MWh project received a £10m grant from the UK government and is expected to enter into operation in 2023.

- InterGen has secured planning approval to install a battery storage system with a capacity of at least 320 MW / 640 MWh in Essex that can be expanded to expand to 1.3 GWh. Construction is set to begin in 2022 for operation in 2024.

UNITED STATES OF AMERICA:

The US Department of Energy (DOE) has set the cost reduction goal as part of the Energy Earthshots Initiative to support breakthroughs in clean energy that make it more abundant, more affordable, and more reliable. The initiative is the first stage of implementation for the Better Energy Storage Technology Act.

The Act also calls for the introduction of an investment tax credit (ITC) for standalone energy storage. Presently the ITC only applies to solar-plus-storage, deployed simultaneously.

Long-duration energy storage technologies will enable a 10-hour duration or more and is what's needed to meet the US policy target of 100 percent clean electricity by 2035. Of the Energy Earthshots that the DOE plans to start, the Long Duration Storage Shot and Hydrogen Shot were the first two to be launched.

The Public Utilities Commission of Nevada in March 2020 adopted the goal of 1,000MW energy storage deployment by 2030 making it the sixth US state to set such an energy storage goal. Massachusetts announced the launch of Clean Peak Standards in June 2020 opening a new chapter in grid evolution.

According to Wood Mackenzie and US ESA, the US-installed 910 MWh of new energy storage systems in Q1 of 2021 – an increase of 252 percent over Q1 2020. The report stated that although Q4 of 2020 saw a record deployment of 2,156 MWh new energy storage systems going online, the deployments slowed in Q1 2021 with a 58 percent reduction.

Deployments are expected to accelerate dramatically in 2021, with almost 12,000 MWh of new storage to be added in the year that is three times more than last year.

Market forecasts indicate that the country's installed energy storage capacity will reach about 4 GW by the end-2021 and further to 7 GW in 2025. This would thereby facilitate the ESA's target of deploying 100 GW of new energy storage in the US by 2030.

The U.S. residential storage market is set for another quarterly record in Q1 2021, breaking the 100 MW installation in a single quarter for the first time. Backup power to complement rooftop solar systems has become the key selling point for residential battery systems in all U.S. markets.

Arizona, Maryland, Nevada, and Virginia are among the States to lead on the energy storage policy, along with California and Hawaii.

Notable projects:

- 176MW and 36MW installed in California and Hawaii respectively

- The biggest project in California: 300MW/1200MWh Vistara Moss Landing Energy Storage plant began operations in January 2021. Construction is underway on Phase II, which will add 100 MW/400 MWh by August 2021.

- AES Corporation energized a 100 MW/400 MWh Alamitos battery storage facility in Long Beach, California, in January 2021.

- Mitsubishi Power Americas and Powin have been awarded an order for two utility-scale battery energy storage system (BESS) projects totaling 640 megawatt-hours (MWh).

- Southern Power's 205 MW Garland Solar Facility in Kern County will add 88 MW and 352 MWh of energy storage, and its 204 MW Tranquility Solar Facility in Fresno County will add 72 MW and 288 MWh. Both projects are scheduled to come online in 2021 and are designed for a 20-year life cycle and four hours of energy storage duration.

CANADA:

The recently introduced Canadian Net-Zero Emissions Accountability Act that aims to achieve a goal of net-zero emissions by 2050, will also see the deployment of energy storage in a big way for the strategy to succeed. Energy Storage Canada released a valuation study with Power Advisory LLC, which concluded that if at least 1,000 MW of energy storage were fully enabled in Ontario, ratepayers would enjoy $2-billion in net savings over the next decade

The country is gearing up for the development of the country's largest storage facility – the 250 MW/1,000 MWh Oneida project. In April 2021, the Ontario government directed the Canadian grid operator Independent Electricity System Operator (IESO), to start negotiations to explore a ten-year contract with the project developers – Six Nations of the Grand River Development Corporation and NRStor Inc. The project, which is being backed by the Canada Infrastructure Bank, is expected to provide important grid-balancing services, thus creating a cost-effective electricity system for Ontario.

Earlier this year, the Canadian Hydro-Québec subsidiary—EVLO Energy Storage Inc. announced that it will deploy a 4 MW/20 MWh BESS on the Hydro-Québec grid, based on the lithium iron phosphate battery technology. The system, which will be the first ESS on Hydro Quebec's grid, will be deployed in the municipality of Parent by the spring of 2022.

In January 2019, the Alberta legislature approved the construction and operation of the Canyon Creek Pumped Hydro Energy Storage Project - the first hydro project to be approved by the Alberta legislature in 10 years and the first large-scale energy storage project in Alberta. It has a capacity of 75MW and supplies power for up to 37 hours.

Further, the Alberta Utilities Commission in April 2020 approved a solar and battery storage project combining 13.5MW of solar generation with 8 MW / 8 MWh of batteries in a rural area of the province. This will be one of Alberta's first major solar-plus-storage projects.

JAPAN:

Japan is one of the world's primary energy and RE markets. It is also the current world leader in smart-grid and energy storage technology. Today, the country is widely considered the biggest market opportunity for new energy innovation. Apart from its plans for widespread implementation of smart-city and smart-grid technology, the country is also making a shift towards a highly diffuse renewable energy infrastructure.

In October 2020, the new prime minister of Japan declared that by 2050 Japan will aim to reduce greenhouse gas emissions to net-zero and realize a carbon-neutral, decarbonized society. In December 2020, the government presented its new 'Green Growth Strategy in line with Carbon Neutrality in 2050'. The strategy sees renewables accounting for between 50-60 percent of electricity demand in 2050.

The world's largest energy storage system is slated to be coming up in Japan. It will have a 240-MW output and 720-MWh rated capacity.

CHINA:

China is set to become the largest energy storage market in the Asia Pacific by 2024. Its cumulative energy storage capacity is expected to skyrocket from 489MW or 843MWh in 2017 to 12.5GW or 32.1GWh in 2024. This signifies an increase in the installed base by 25 times. Maturity in technology and ensuing cost reduction, are key factors that will contribute to the exponential growth in China's energy storage market through to 2024 (estimated to surpass $6 billion).

China plans to install more than 30GW of new energy storage capacity by 2025, in a bid to boost renewable power consumption while ensuring stable operation of the electric grid system. New energy storage refers to electricity storage processes that use electrochemical, compressed air, flywheel, and supercapacitor systems.

China has a total energy storage capacity of about 35 GW as of 2020, of which only 3.3 GW was new energy storage, according to the China Energy Storage Alliance.

The country is the world's biggest electricity generator and carbon emitter and is working at increasing its renewable power from 42 percent at present to more than 50 percent of its total electricity generation capacity by 2025. At least 10 regions in China have ordered renewable power developers to install energy storage as supporting facilities for the solar and wind plants.

China had 1.2GW/1.7GWh of new non-hydro energy storage additions in 2020, reaching 2.7GW/4GWh of total deployments by the end of the year. It is expected to add 430GW of new solar and wind capacity in the next five years, which could eventually spur 74GW of new storage capacity.

China will likely overtake the US and lead the market at the country level in 2025. The market for battery energy storage in China is estimated to reach $3.22bn in 2025.

SOUTH KOREA:

South Korea is one of the most developed markets for Energy Storage Systems, with a deployment that accounted for one-third of the world's ESS capacity in 2018 at almost 1GW, as per India Energy Agency (IEA) figures.

ESS installations in South Korea have been increasing steadily, with a drop seen in 2019 to about 600MW installations. Overcoming this setback, the Ministry of Trade, Industry, and Energy (MOTIE) and other bodies of the government has paved the way forward for South Korea to be one of the leaders in the Energy Storage Sector due to the aggressive policies and strong stand in favour of Energy Storage.

Asia-Pacific (APAC) was the largest market for battery energy storage systems in 2020, accounting for 49.9 percent of the global market installed capacity. The region is expected to maintain its top position in the forecast period up to 2025, as well as its market share of approximately 53.5 percent in 2025, followed by Europe, the Middle East and Africa (EMEA), and the Americas.

Middle East and North Africa (MENA):

Though long considered for their fossil fuel reserves, the countries of MENA are fast establishing themselves as global producers of clean, renewable energy. As the use of RE grows in scale in the future, demand for energy storage as a method of alleviating wind and solar generation in the grid will increase.

Battery storage systems are already being deployed at multiple levels of the electricity value chain in the MENA region, including at the transmission, distribution, and consumer levels. Energy storage deployment in emerging markets is expected to increase by over 40 percent each year until 2025.

United Arab Emirates (UAE):

Major renewable energy projects are still underway and on track in the UAE including the major Al Dhafra Solar Plant in Abu Dhabi and the Mohammed bin Rashid Al Maktoum Solar Park (MBR) in Dubai.

Dubai Electricity and Water Authority (DEWA) and Siemens Energy have inaugurated the Middle East's first industrial-scale, solar-powered green hydrogen project. With power provided by the MBR, which at present has a capacity of 1,013MW, the pilot plant is anticipated to produce around 20.5kg of hydrogen per hour.

Around 1,850MW of solar capacity is at present under construction at the MBR mega-project, which will reach 5GW when fully operational in 2030 and be the world's largest single-site solar plant. DEWA is set to commission the 300MW first stage of the fifth phase of the MBR solar park, which will have a capacity of 900MW.

AFRICA:

The lack of a robust grid network, limited technology deployment, and over-reliance on expensive diesel generators make a strong case for small-scale solar PV or wind or hybrid technologies in Africa, backed by a storage component that will help improve system reliability.

Energy storage technologies are viewed as a potential game-changer for the widespread adoption of RE generation throughout Africa. Storage can charge and discharge energy as required on-demand, making it a key piece of the stable energy infrastructure needed to improve grid reliability and security in Africa. The continent is rapidly moving to harness the potential of RE.

RE will be at the heart of any significant energy transformation in Africa, bringing economic and environmental potential to the continent's consumers and communities. Energy storage and flexible power plants will be their key enablers.

Notable projects:

- Eos Energy Storage, a manufacturer of long-duration zinc battery storage systems, along with Nayo Tropical Technology - a West African mini-grid EPC company, will deploy additional units of Eos Aurora EnergyBlock systems rated at 125 kW / 500 kWh, at four rural micro-grid projects in Nigeria in the first quarter of 2021. The EnergyBlock systems can operate without heating, ventilation, and air conditioning, allowing it to even operate in hot climates.

- Azelio AB has signed an MoU with Morocco-based Jet Energy to explore approximately 45 MW of storage projects in Francophone Africa from 2021 to 2025.

- Energy Resources Senegal, an energy developer, and Climate Fund Managers, an investment group in renewable energy and sanitation, have agreed to jointly build the first solar-plus-storage plant in Niakhar, a town located near Dakar. The large-scale energy project will integrate 30 MW of PV with 15 MW / 45 MWh of battery storage.

India and SAARC countries:

Energy storage is emerging as a necessity in all the South Asian nations with renewable energy capacities being rapidly scaled up, the cost of solar PV and wind-based power is dropping significantly, and RE price parity with fossil fuel power is challenging the operational philosophy of the grid.

Countries in SAARC have taken a multi-pronged approach to energy storage through policy intervention in key focus areas such as RE integration, faster adoption of EVs, improving the reliability of rural micro-grids and efficiently meeting the energy needs of smart cities.

According to the India Energy Storage Alliance (IESA) report, the total annual MWh addition in 2018 hit 24.4GWh and is expected to grow to 64.5GWh by 2026. IESA estimates the market for energy storage would grow to over 300GWh during 2018-25.

INDIA:

The government of India has set a target of installing 175GW of renewable energy capacity by the year 2022 - penetration of RE in the grid necessitates energy storage systems for grid balancing. Further, the Ministry of New and Renewable Energy has indicated that it is considering all future renewable tenders with the inclusion of energy storage.

Some notable developments in India in the BESS segment include the recent commissioning of a 20MW solar power project integrated with an 8MWh battery energy storage system by the electricity department of the Andaman and Nicobar administration. It is India's first largest utility-scale BESS system to date.

In March 2019, the National Mission for Transformative Mobility with Phased Manufacturing Program for Li-ion battery manufacturing was launched in India by the NITI Aayog. India is also focusing on domestic manufacturing for all types of energy storage technologies including advanced lead-acid, thermal storage, and ultra-capacitors apart from Li-ion batteries.

In a much-awaited announcement in early May, the Cabinet headed by the prime minister approved the proposal of the Department of Heavy Industry for implementation of the production-linked incentive (PLI) scheme 'National Programme on Advanced Chemistry Cell (ACC) Battery Storage'. The objective of this program is to achieve a manufacturing capacity of 50GWh of ACC and 5GWh of 'niche' ACC, with an outlay of Rs 18,000 crore.

The government is planning to set up Giga factories for battery production with the emphasis of the scheme being on promoting cell manufacturing in India and reducing reliance on the import of battery cells. Reports suggest that domestically, India's projected need is of six gigawatt-scale plants of 10 GWh each by 2025 and 12 by 2030.

IESA estimates that the EV market is expected to grow at a CAGR of 44 percent between 2020-27 and is expected to touch an annual sale of 6.34 million units by 2027. Needless to say, demand for energy storage solutions will be inevitable with growth in EV manufacturing.

The annual battery demand is evaluated to grow at 32 percent to reach 50GWh by 2027, and the battery market is expected to grow to $14.9 billion by 2027. India will lead the battery storage market and contribute 35 percent of the total global battery deployment for energy storage by 2040 as per the International Energy Agency. Indian stationary energy storage requirement is expected to grow nine times at a CAGR of 22 percent during the forecast period of 2022-32.

BHUTAN:

Bhutan is one of several Asian countries that generates power mostly from clean energy sources. Its electrification program aimed to achieve 100 percent electrification of the country by 2020. The country's extensive hydropower potential has been mapped at 30,000MW, of which nearly 80 percent is deemed feasible from a techno-economic perspective.

The Asian Development Bank (ADB) has approved a $3 million grant to implement a renewable energy pilot project, that is part of the government of Bhutan's 12th Five Year Plan - 2018–2023.

MALDIVES:

Given its unique geographical location, Maldives does not have access to conventional energy like fossil fuels and hydropower, etc. Its energy needs are met primarily through the import of fossil fuels. This situation makes energy security a priority for the Maldives. It also puts the country at greater risk and exposure to the market prices in the world energy market.

The situation in the Maldives makes it a potential region for storage application. Together with natural renewable sources, storage can make a significant impact and help reduce the country's overall energy import costs.

To reduce the reliance on expensive diesel-powered grids, the Environment Ministry of the Maldives and the Asian Development Bank (ADB) launched a plan to install solar+battery+diesel microgrids across 48 islands. The project comes under Preparing Outer Islands for Sustainable Energy Development (POISED). By the end of 2020, 9.5MW of solar photovoltaic capacity, 5.6 MWh of battery storage, 11.6MW of energy-efficient diesel generators were installed under this project.

In June 2021, the Ministry of Finance released a tender for delivering turnkey BESS of 40MW / 40MWh and energy management systems (EMS) to support solar PV-plus-diesel hybrid power systems.

NEPAL:

Nepal faces a power deficit problem, in addition to installed capacity issues, that is intensified due to the seasonal nature of hydroelectric power in the country. During the winter season when the river flows dry up, the power output of the predominantly hydroelectric power system of Nepal falls leading to seasonal load-shedding of up to 12 hours.

Storage has been playing a role in the hydroelectric sector, in the context that close to 14 percent of the installed capacity in the power sector is 'dam storage, which essentially allows for storage that can be used in later seasons when the water dries up.

SRI LANKA:

The power sector entities in Sri Lanka have limited ability to generate new investments in the generation, transmission, and distribution areas, due to insufficient cost recovery mechanisms through the tariffs. The need for demand-side management is very significant here, with a nearly 40 percent difference between the peak and off-peak demands of the country. This provides a potential for electricity storage to bridge this gap and level of the peak.

Sri Lanka is also one of the few SAARC countries that have exhibited an active interest in storage. From a policy perspective, the country planned to have up to 20 percent penetration of renewable energy by 2020, and a very ambitious long-term plan to increase this to 100 percent.

BRAZIL:

Brazil's latest 10-year energy expansion plan seeks to maintain hydro generation while increasing the share of non-hydro renewables, particularly solar. In 2016, the Brazilian Electricity Regulatory Agency (ANEEL) launched an R&D program for grid-connected energy storage projects, the first generation of which has already been implemented.

In 2018 AES Tietê commissioned the first energy storage project connected to the Brazilian National Interconnected System. Sodium and lithium-sulphur battery storage was used the first time, after NEC ES and NGK signed deals to deliver projects to an island archipelago in Brazil in July 2018. In a line-up of trial deployments of battery storage in the region, Engie tested novel zinc batteries from Eos Energy Storage 'to their operational limit' in 2017, while in 2018 another novel battery tech, a 50kW/400kWh test unit of ESS Inc's 'all-iron flow battery was also introduced in the State of Goiás, Brazil.

There are few applications in photovoltaic systems that include electrochemical storage, which is being restricted to universities and research centers. The applied case is the photovoltaic system installed at the University of São Paulo, which has several bidirectional inverters installed in several single-phase and three-phase mini-grids used for tests and research by the Energy and Environment Institute.

LATIN AMERICA:

According to World Economic Forum, energy storage will affect the entire electricity value chain across Latin America as it replaces peaking plans, alters future transmission and distribution investments, reduces intermittency of renewables, restructures power markets, and helps to digitize the electricity ecosystem.

In Mexico, General Electric announced plans to develop five energy storage projects that will help integrate solar and wind projects into the grid. In the Dominican Republic, two 10MW arrays of batteries were installed by AES Dominicana, which helped the country's grid remain operational when Hurricane Irma struck a few weeks later. In June 2020, the Chilean government awarded development rights for 11 utility-scale renewables projects in the country, totaling more than 2.6GW.

The AES Corp has begun constructing a 112 MW / 560 MWh BESS project in Chile, which will be the largest battery storage system in Latin America to date and Chile's first solar plus storage project. The batteries will be paired with 253 MW of solar energy generation. The battery systems will be supplied by Fluence.

Highview Power, a provider, and integrator of zero-emissions liquid air energy storage systems suitable for large-scale and long-duration applications announced a joint venture with Energia-Latina S.A. Enlasa, to co-develop 'giga-scale cryogenic energy storage projects' in Chile and other parts of Latin America.

AUSTRALIA:

The adoption of energy storage in Australia is largely driven by funding and incentive programs from the Australian Renewable Energy Agency and State governments. Regions with higher penetration of RE generation have witnessed significantly higher growth in the adoption of energy storage technology in comparison to regions with significant coal or gas generation. The adoption of energy storage has been primarily at the utility and residential levels, as well as for the off-grid commercial sector.

Australia had planned to add 1.2GWh of energy storage capacity in 2020, more than double the 499MWh installed in 2019 (Wood Mackenzie) – increasing the country's cumulative storage capacity to 2.7GWh.

Some landmark projects in the region include the Hornsdale Power Reserve, the world's largest operating battery developed by French renewables developer Neoen. It is a 100 MW/129 MWh Tesla big battery project in South Australia. Neoen in April 2020, had announced plans to develop another massive battery storage system near the Australian city of Geelong – a 600MW battery storage facility dubbed as 'Victoria big battery'. General Electric (GE) also won its largest battery deal so far to support the 200MW Solar River Project in South Australia, which will be combined with a 100MW – 300MWh GE Reservoir grid storage system. The project already is slated to start generating power by 2021.

CEP Energy has announced plans for a 1,200 MW battery in NSW's Hunter Valley to be built in stages, with the first to be delivered by 2023. The A$2.4bn (US$1.85bn) project will eclipse California's Moss Landing Energy Storage Facility to become the world's largest battery energy storage system. CEP has plans to be part of a network of four big grid-scale batteries across the country with a total capacity of 2,000MW.

NEW ZEALAND:

New Zealand relies on renewable energy for 90 percent of its electricity demand; however, solar PV accounts for 1 percent of the nation's energy mix with around 97MW of installed capacity.

In 2020, the Rural Connectivity Group (RCG), a New Zealand-based telecommunications company, confirmed an order with Redflow to supply zinc bromide batteries that will be installed along with solar at 10 telecom tower sites.

In August 2018, the first grid-scale battery energy storage system in New Zealand was inaugurated. The 1MW / 2MWh of power packs connected to existing pumped hydro facilities in South Auckland and used by project owner Mercury's R&D centre as part of a trial of scalable grid-connected batteries.

In December 2018, in a bid to cut emissions further, NZ made two big announcements: the launching of what is said to be the world's largest virtual power plant (VPP); and the establishment of a NZ$100 million ($69 million) Green Investment Finance facility. To fulfill the first commitment, the New Zealand-based solar company connected 3,000 residential solar-plus-storage systems to the national grid.

SINGAPORE:

Singapore, though committed to relying on natural gas for the next 50 years, has announced the target of 200MW of energy storage beyond 2025. This announcement is in line with the vision of having a network of energy storage solutions across the entire island to manage the stability and resilience of the grid, as well as offering peak shaving services.

Singapore lacks geothermal, wind, and tidal resources, and therefore the energy storage vision is partly driven by the expected push for solar energy installations in the coming years. The island has had roughly 3,000 grid-connected PV installations over the last decade and has set a goal of 2GW of PV by 2030. Singapore government launched the Accelerating Energy Storage for Singapore (ACCESS) to facilitate ESS adoption by promoting use cases and business models.

Keppel Offshore & Marine and the Singapore Energy Market Authority have awarded a research grant to develop a floating 7.5 MWh energy storage system. The grant is part of a push to develop innovative energy solutions for the marine sector. The system features a battery-stacking feature with the potential to increase the efficiency of the system's deployment. The floating system will be Singapore's largest energy storage system to date.

This region could also witness a new chapter in the history of green power with the Australia-ASEAN Power Link, which was endorsed in July 2020 by the Australian government. The ambitious renewable energy storage project envisions connecting the world's largest solar farm and battery system in Australia's Northern Territory to Singapore and Indonesia via a 3,700km undersea cable.

INDONESIA:

Indonesia, though it has a small amount of solar PV at present, has a large solar potential given its tropical location. Reports estimate that less than 1 percent of Indonesian land would be required to produce all of the nation's electricity using solar PV.

Indonesia has a target of reaching 23 percent of renewables share in the primary energy mix by 2025 and 31 percent by 2050. The Indonesian government has entered into an MoU with CAT to install hybrid microgrids in 500 islands in the country.

However, it has been struggling to meet the targets with renewables accounting for only 8 percent of the primary energy mix in the country. The main factors for stunted growth in the renewables sector have largely been - regulatory and policy uncertainty, market barriers, financing barriers, and undeveloped local renewable industry.

PHILIPPINES:

In the Philippines, the government has started taking into consideration the role of regulators in enabling policy framework and in boosting the adoption of energy storage.

In April 2019, with the view to accommodate energy storage as an enabler for the modernization of its electricity networks, the Philippines Department of Energy (DoE) issued a circular – 'Providing a framework for energy storage system in the electric power industry'. In October 2019, Philippines power utility Meralco and battery supplier Hitachi installed a 2MW / 2MWh battery energy storage system (BESS) on the country's largest island, Luzon. Claimed to be the country's first grid-scale distribution-connected BESS, the project served as a pilot to help the Philippines's largest utility understand and further integrate battery storage technologies.

Penetration of Li-ion batteries for island electrification has already kick-started in the Philippines with nearly 0.5 GW installed. Philippines Energy Plan 2012 – 2030 is supportive of energy storage integration on the grid.

THE Energy Regulatory Commission (ERC) recently promulgated rules governing the Green Energy Option Program (GEOP), a mechanism allowing electricity end-users in the Philippines to choose renewable energy as their source of energy.

Notable projects:

- Fluence installed two battery energy storage projects in the Philippines of 20 MW/20 MWh each in June 2021. The company announced that it would be commissioning another 430 MW/430MWh of BESS in the country by 2022.

- Filippino energy group SMC Global Power Holdings Corp announced in April 2021 that they would be investing in a total US$1 billion energy storage for 1000MW of BESS projects in the country.

- The technology group Wärtsilä said it has signed multiple energy storage contracts with SMC Global Power Holdings,through its subsidiary Universal Power Solutions, in the Philippines during 2019-2020. The first two projects, Integrated Renewable Power Hub-Toledo and BCCPP, Limay, Bataan, achieved final commissioning in May. The projects have a capacity of 20 MW / 20 MWh and 40 MW / 40MWh respectively and are part of the earlier announced energy storage orders.