Import ban on Chinese equipment: driving India’s clean energy quest

Power Minister RK Singh has recently announced that India will not permit import of power equipment from China citing recent transgression. The directive, which trailed the announcement, also specified that any import of equipment, components would necessitate erstwhile permission of the government of India and would have to undergo testing in certified and designated laboratories sanctioned by the ministry.

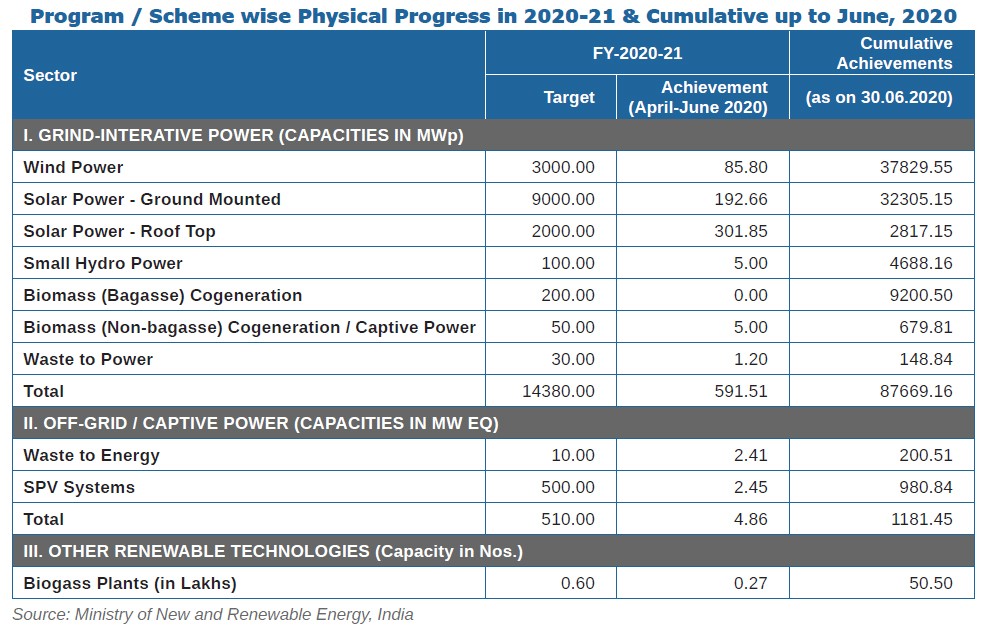

India's renewable power capacity is accelerating and is among the most encouraging markets in the Asia-Pacific. The government of India has set a target, as part of the country's commitment to the United Nation's Sustainable Development Goals, to install 175GW of renewable energy capacity by 2022, comprising 100GW from solar.

The renewable energy (RE) sector in India has gained substantial momentum in the last five years, principally driven by the Paris climate commitments. As per the Ministry of New and Renewable Energy (MNRE), India has grown 72 percent from 80GW to 138.9GW, while an additional 62.4GW capacity is currently under various stages of implementation and 34.07GW is under various stages of bidding.

Several policy initiatives have been taken in the recent past to encourage growth in the sector—these comprise removal of tariff caps, support for the KUSUM scheme in the budget, and the launch of Phase-II of the Grid Connected Rooftop Solar Programme. It was projected that these policy measures would boost RE deployment in the imminent years. However, the COVID-19 pandemic has considerably impacted the growth in the RE sector in India.

According to Power and New & Renewable Energy Minister R K Singh, India will have about 60 percent of its installed electricity generation capacity from clean sources by 2030. The minister also conveyed confidence that the renewable energy capacity would touch 510GW by 2030, including 60GW of hydropower.

Chinese equipment & Indian RE sector

China is India's biggest source of imports. Chinese imports such as electronic goods, industrial machinery, and organic chemicals equaled nearly $70 billion in 2019. China has a trade surplus of about $50 billion with India.

India has long relied on Chinese equipment for power generation and transmission to deliver affordable electricity. All along, cheap solar modules and wind turbine components (mainly castings) imported from China helped India roll out a respectable quantum of RE capacity.

China accounted for $2.8 billion of the total $7.8 billion of equipment for non-renewable power projects imported in the year ended March 2019.

Indian solar companies are highly reliant on China in terms of importing components as over 80 percent of solar cells and modules are imported from the country because of its competitive pricing compared to domestic manufacturers. India imports 8000-10000MW of solar modules each year, of which close to 90 percent is from China.

Indian solar power developers imported over $6 billion worth of Chinese solar cells and modules between FY 2017 and FY 2019. There was a sharp 45 percent drop in value of imports between FY2018 and FY2019.

Market experts opined that in the present scenario, India's solar sector is essentially dependent on the procurement of raw material from China. The same is not the case for wind equipment but solar about 85 percent of cells and modules are still imported, commonly from China. China has worked belligerently on ramping up not just RE generation, but production and manufacturing as well and is currently the world's largest exporter and installer of solar panels, wind turbines, batteries, and EVs. Specific to solar, China is fully integrated with polysilicon production, to wafers, cells, and modules.

While the Chinese companies ruled the fast-growing domestic market for solar companies due to their competitive pricing, India lately awarded a manufacturing-linked solar contract, in addition to its existing domestic manufacturing capacity of 3GW for solar cells, which will help in instituting additional solar cell and module manufacturing capacity.

Ban on import of Chinese equipment

RK Singh has announced that India will not allow the import of power equipment from China citing recent transgression in border areas and cybersecurity threats. Imports from other nations will need permission.

The directive, which trailed the announcements, also specified that any import of equipment, components, or parts from "prior-reference" countries would necessitate prior permission of the government of India and would have to endure testing in certified and designated laboratories approved by the ministry.

Highlighting the need for self-reliance in the sector, Singh said the country's power equipment import bill was about `71,000 crore during 2018-19, comprising purchases worth over `20,000 crore from China, even when the country had manufacturing facilities.

The South Asian nation has the capability to manufacture all kinds of electrical equipment, Singh said at a meeting with energy officials of States, inspiring them to promote local procurement. To check imports of renewable power equipment, the country plans tariff barriers instead of a complete ban on any country, Singh said.

Following the ministry's directive, the Director-General of Trade Remedies (DGTR) has suggested the extension of the safeguard duty (SGD) on the import of solar cells and modules to India for the additional year starting July 30, 2020. In its notice, the DGTR suggested a rate of 14.90 percent for the first six months and 14.50 percent for the following six months on all solar cells and module imported from the China PR, Thailand, and Vietnam, observing that imports from all other developing nations will not attract the duty.

The 25 percent safeguard duty, announced on July 30, 2018, was levied on solar cell and module imports from China and Malaysia, to protect domestic cell and module manufacturers. The duty was set at 25 percent for the first year, trailed by a phased down approach for the second year, with the rate reduced by 5 percent every six months until it ends on July 31, 2020.

The commerce ministry is individually assessing non-tariff measures such as more inspections, product testing, and enhanced quality certification requirements to check Chinese imports in a way that conforms to the World Trade Organization (WTO) rules.

To learn more about the impact of the Chinese equipment import ban and planning future indigenous manufacturing strategy, ETN spoke to industry pioneers and discussed the development for more on-ground insight.

MNRE has imposed a ban on the import of Chinese equipment for Indian projects. In your view, how will this impact/advantage the Indian RE sector?

Hitesh Doshi: In my view, this is a very good step planned by the government of India. One manufacturing unit brings thousands of direct and indirect jobs. A huge amount of foreign exchange that goes out of the system never comes back and another, if manufacturing booms then you have money in your system, which keeps rotating and keeps giving taxes and creates additional employment for the long term.

We, as a country, need Energy security; we are not buying solar panels instead we are buying 25 years' solar energy, so it is not just the import of panels for India, it is paying upfront for future energy generation. Hence, this step will help the country gain energy security. This will help bring in new manufacturing in India and the expansion of existing manufacturing facilities.

We will see more and more new investment in manufacturing and R&D. I am sure with this support Indian manufacturers shall start filing patents in the coming years for innovative and disruptive technologies, to boost solar energy production.

Imaan Javan: While MNRE has imposed a ban on the import of Chinese equipment for Indian projects, we are certainly not prepared for the situation and with the COVID-19 pandemic it's really going to test us. Having said that, we should make the most of the situation, and move forward with the initiative. Ten percent of the companies are ramping up for the situation and ready to cash in but since we don't have much time or a strategic plan for it, the quality might suffer. We are heavily dependent on China for this for a long time, but this initiative will change the due course shortly. So, considering long-term benefits, this is a welcome move and the industry will definitely benefit from it.

Animesh Damani: As a developer of RE projects, the focus is on the import of equipment required to build a solar project. As per my understanding, there is no ban currently imposed on the import of solar equipment such as cells, modules, inverters, etc., that are critical to the building of a solar project. Moreover, it would be impractical to impose a ban as domestic manufacturing capacity cannot meet the current demand for solar modules.

The imposition of customs duty of 25 percent initially and then 40 percent will knock the wind out of the sails for the solar sector. At 40 percent customs duty, solar project costs will escalate anywhere between 17-25 percent. We can expect utility bid prices to go up sharply. The roof-top segment will see negative growth and could operate at 25-30 percent of the current installation pace.

What future steps/plans will help the renewable sector to ease the dependency on China and enhance indigenous manufacturing?

Hitesh Doshi: Return on Investments (ROI) for manufacturing takes 7-8 years, hence Investors need clear market visibility and long-term policy. If the dumping of solar modules continues, then manufacturing won't grow, so immediate action to stop dumping should be implemented.

Imaan Javan: Solar used to have subsidies across the board but now subsidies are only limited to residential projects, and these projects are not that large in numbers. If you really want to try to incentivize people and go for solar then you have to take some bold steps and look from the viewpoint of a common man and how we can assist them in making the move towards solar. Instead of subsidies, we can give them some tax breaks. Like in the USA, they have 26 percent flat ITC (Income Tax Credits) across the entire country no matter which State you are in and they have different benefits for the State and benefits from the utility. It's not the case over here in India. When you see a tax benefit to it, you find more people going towards it as everyone wants to save on taxes.

The entire crisis of COVID-19 should be taken as a wake-up call by the government, and they need to encourage people and provide some benefits to them to start manufacturing in India more than what they did and see how they can assist and subsidize it.

Animesh Damani: A comprehensive manufacturing policy is required that:

- addresses supply chain issues, such as lack of ingots and wafer manufacturing

- focuses on enhanced silicon cell and module manufacturing

- encourages technology sharing and constant upgradation

- protects from cheaper imports while ensuring project costs do not escalate due to protectionism

PM Modi has called for Atmanirbhar Bharat (self-reliant India) strategy across the sectors. How equipped is the industry to fall in line with the same? What kind of challenges is the industry likely to face?

Hitesh Doshi: Indian entrepreneurs are well equipped, and they have proved themselves many times, if the right policies are implemented for the long term and a conducive environment is created we can be the second largest manufacturing hub in the upcoming 2-3 years

Imaan Javan: As Prime Minister Modi has called for Atmanirbhar Bharat, people in India could get more opportunities to produce 'Make in India' products. But considering various factors like infrastructure and labor we are still not 100 percent ready to be atmanirbhar and are at the first step of laying the foundation; for the results to show up it will definitely require adequate time.

Because the 'Make in India' campaign has been around for a while and the solar vendors are still not being able to cope with the required quantity and quality at the desired price. Some people are very patriotic and nationalist and they may go for it, but in the financial world, people look at what money you are paying in the end for what you are getting. Keeping everyone in mind, that is why most of us depend on China as they almost provide 80 percent of the products that we use. They will make an entire sound ship around a product that you want and give it to you at a sustainable price. That's why it's not possible in India to be self-reliant immediately.

Animesh Damani: The Indian silicon cell manufacturing capacity is about 3.1GW (split between 18 companies), and that of modules is 11GW (consisting of 175 companies). A sizeable portion of this stated capacity is made up of obsolete technology. Realistically, we are unable to meet our demand for solar modules through domestic manufacturing.

With 3.1GW of silicon cell manufacturing, even at 100 percent production levels, Indian silicon cell manufacturing capacity can meet only 28 percent of the demand given by the module manufacturers. The import of silicon cells is critical to meet module demand.

Hence, most of the module manufacturers in the country are assemblers who are heavily dependent on the import of solar cells to assemble the modules in India. The majority of Indian manufacturers are unable to compete on the pricing and quality offered by their Chinese competitors. Apart from a couple of GW scale companies, most manufacturers are in the 50-200MW range. The fragmented nature of the Indian manufacturers does not offer any economies of scale. This makes them more expensive and unable to invest in up-gradation of their technology.

Moreover, the Chinese have deep vertical integration of the supply chain straight from making of ingots to wafers to cells to modules. This reduces their cost of production and gives them better control over the pricing. On the contrary, India does not have any local manufacturing of ingots and wafers in the country and is entirely dependent on China for the same. Ingots and wafers are required to produce the silicon cells that go into the modules.

What kind of opportunity do you see for energy storage in the country?

Hitesh Doshi: As an Indian manufacturer, we are very optimistic and have started a new venture in energy storage. It will be much bigger than we are thinking today, though it will take some time to pick up it will grow much faster.

We have already lost 10 years to bring solar manufacturing in India, now we should avoid the same in storage and take immediate steps to boost manufacturing.

Imaan Javan: India is finally seeing the emergence of a grid-scale energy storage market after years of anticipation. India has massive solar and wind deployments since 2010, but the grid-scale energy storage market remains untapped. At the same time, Indian manufacturing concerns are keen to gain a foothold in the fast-growing battery market, this is because energy storage is the next big thing especially due to the emergence of EVs and there is a rising demand for energy supply for these kinds of technologies. Also, these technologies will come with their share of pros and cons but it is noteworthy to highlight the fact that EVs will reduce carbon emission dramatically, which is also the need of the hour; to save the planet from catastrophic climate disasters.

Globally, these are the initiatives that are making the difference and India is not that behind but we really need to focus on building a strong foundation in terms of infrastructure and flexible policies to make this happen. At Suntuity group we have been using solar plus storage and we are working on introducing it in India. It's just that this year we were really geared up to go all out, but due to COVID-19, it's going to take some more time. The current situation has some disadvantages for the renewable industry but hopefully, we will come out stronger than what we are dealing with it right now in a few years

Animesh Damani: There is a massive potential for energy storage in India. Increased renewable penetration in the generation mix will make energy storage central to the future sustained growth of RE. To deal with the infirm nature of RE, we currently depend on thermal power and hydropower for grid balancing. Moreover, thermal power is required for baseload.

Storage will find applications that deal with the infirm nature of renewables to reduce dependence on coal. It will be able to absorb peak power production and address peak consumption. Currently, storage costs are extremely high but are expected to become a real threat to coal by 2025.

Strengthening indigenous manufacturing through 'Make in India

MNRE has advised States to set up RE equipment manufacturing parks to meet domestic demand as well as make India a global production hub.

To make Chinese imports less attractive to project developers, the government is considering actions to ramp up the production of domestic cells and modules. SECI lately accomplished the world's largest solar power tender that had a major manufacturing component as well. Adani Green Energy and Azure Power were awarded a total power generation capacity of 12GW and 3GW of solar module production capacity.

According to an industry report, the government is also planning to develop a solar cell manufacturing capacity of 4GW. The government plans to offer some capital subsidies to invite investment in this sector.

Apart from offering incentives to set up manufacturing facilities, the government has also taken steps to generate a market for domestic modules. MNRE runs a 12GW scheme solely for government-owned companies. As part of this scheme, government-owned companies can set up solar power projects for their own use or sale to other government-owned companies. However, all these projects must use locally manufactured cells and modules. The government has allocated $1.2 billion to offer a capital subsidy to government-owned companies looking to set up solar power projects. Inopportunely, tenders issued under this scheme have not established a healthy response from government-owned companies. The first tender of 2GW capacity acknowledged just over 1GW of capacity.

The government is pushing public sector companies to set up more RE projects to guarantee that there is a large enough market to absorb solar modules projected to be produced over the next few years. Companies like NTPC, NHPC, Indian Railways, NLC, Coal India, and Indian Oil Corporation have declared ambitious RE capacity addition targets.

There is an urgent need for India to formulate a policy framework aimed at creating a diversified domestic manufacturing industry for solar modules as well as ancillary products. One that could considerably reduce its import dependence, ensure self-sufficient, sustainable, and inexpensive energy access and generate greater employment opportunities.

The lack of a consistent government policy and financial support to match the scale, quality, and low price of Chinese imports, has challenged the growth of India's solar technology and manufacturing. A belligerent strategy for the long-term development of the industry in line with the National Solar Mission that addresses price competitiveness, profitability, feasible finance, and capacity gaps in the immediate need of the hour. The sustainable domestic manufacturing industry can save $42 billion in equipment imports by 2030, provide equipment supply security, and create 50,000 direct and 125,000 indirect jobs in the subsequent 5 years.

The solar cell manufacturing process is technology and capital concentrated. In the value chain of solar PV manufacturing that involves polysilicon, wafer, cell, and module assembly, most Indian companies are involved in later processes of module assembly. India has no technical expertise in capital-intensive processes of silicon and ingot production. With 246 patents, India's competency in solar technologies remains unfavorably low as compared to leading solar manufacturing country China with 39,784 patents. There are incremental changes in technology at recurrent intervals in the process of manufacturing that require capital and know-how to absorb. As the cost of obtaining technology is high, India must incentivize and step up its own research and development of cost-effective, indigenous, next-generation solar panel manufacturing technology.

The country's efforts to transition to renewable energy technology, reshaping investments, generating new jobs, and generating wealth in the sector can help generate possibilities for healthy, resilient, and flourishing future economies. However, to secure a leadership position, it must fast-track the transition to clean power with levers such as knowledge, technology, partnerships, and policy.

The ensuing few years will disclose how the Indian industry can blossom in a supportive policy environment. It will be remarkable to see if Indian manufacturers can ramp up production, offer competitive rates to project developers, and outdo Chinese suppliers.