Green H2: a key element in India’s decarbonization strategy

India has committed to meet 50 percent of its energy requirement through renewables, and accordingly, a target of 500 GW installed renewable energy capacity is set by 2030. Anish Mandal (Partner) & Himadri Singha (Associate Director), at Deloitte India, discuss the potential of green H2 in India's decarbonization initiatives, while addressing the challenges in H2 adoption and the cost economics.

India is currently the third-largest emitter of greenhouse gases globally (as per world media reports), and the country is witnessing several climate-related risks - rising temperatures, more frequent droughts, and extreme weather events. However, India is one of the few parties to the Paris Agreement to have adopted emissions reduction targets. India has committed to meet 50 percent of its energy requirement through renewables, and accordingly, a target of 500 GW installed renewable energy capacity is set to be achieved by 2030.

While the transition to renewables is expected to address emissions from the electricity sector, the remaining ~55-60 percent (including transport) of emissions reduction would require other forms of deep decarbonization. Green hydrogen is one of the potential alternatives to decarbonize harder-to-abate sectors, such as fertilizer, refineries, transport, cement, steel, etc. There are three major reasons behind the sudden push for green hydrogen:

- 1. Electricity and other forms of decarbonization initiatives (e.g., carbon capture and storage) have certain limitations to decarbonize industrial sectors

- 2. Declining cost of renewables and expected reduction in capital cost of electrolyzer systems

- 3. Significant attention from policymakers and corporates – government of India has already announced some policy measures, and major corporates like Reliance, Adani Group, JSW Group, Indian Oil Corporation Limited, NTPC Limited, etc., have expressed their plans for large-scale investment in the green hydrogen ecosystem

H2 cost economics

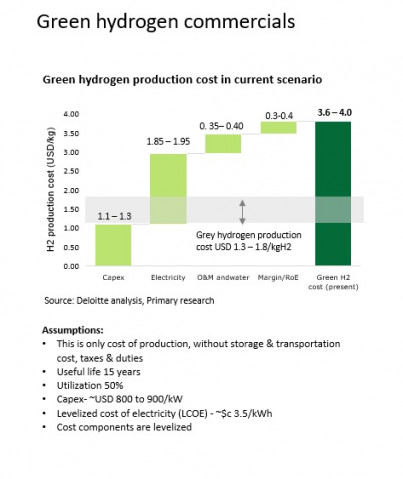

While the long-term potential of hydrogen is intact, the near-term potential and scale-up are constrained by unfavorable cost economics. Green hydrogen has strong use cases in several sectors, such as refineries, fertilizer (as feedstock), steel (as an oxidant), cement (energy source), surface transport, aviation, shipping (energy carrier), etc. It currently falls short of being cost-competitive vis-à-vis grey or other sources of energy – a cost difference of about ~$1.5–2.5/kg over grey hydrogen. This difference in cost is believed to be the major deterrent for the Indian industries to adopting green hydrogen.

In this context, carbon pricing could be a valuable tool to accelerate green hydrogen adoption in harder-to-abate sectors. A carbon tax of $50-60/ton may bring parity between green and grey hydrogen in some of these industries by FY27. Organizations that have pledged to net-zero ambitions and introduced an internal carbon pricing framework for decision making are likely to explore green hydrogen use cases.

The low cost of dispatchable RE, technological advancements, economies of scale, and increase in natural gas prices are expected to bring cost parity between green and grey hydrogen.

Key considerations that should be analyzed and tracked are:

- Electricity cost accounts for 50-60 percent of the green hydrogen cost of production; availability of low-cost RE is key to achieving cost parity.

- Electrolyzer Capex is expected to decline by 60-70 percent by 2030, considering a similar learning rate of similar technologies (battery, solar modules, etc.); Capex cost would account for 25-30 percent of the total cost of green hydrogen production.

- With 3-4 percent y-o-y growth of natural gas price, grey hydrogen cost of production is expected to touch $2.3-2.5/kg by 2030; the cost of green hydrogen by 2030 could be at par with grey hydrogen, considering the increase in gas prices.

Blue hydrogen (with carbon capture and storage) could become a viable alternative for industrial grey hydrogen till the time green hydrogen becomes economically viable and picks upscale. Refinery sites, where carbon storage utilizing storage tanks could be accommodated, could be the early embracer of the technology. With a Carbon Capture & Storage (CC&S) cost of $50-60/ton, blue hydrogen would cost an additional $0.5-0.6/kg of hydrogen (1kg grey hydrogen produces ~10kg CO2), which would still be cheaper than green hydrogen.

Green H2 transition readiness

The ease of transition would vary across the sectors, depending on several factors, such as technology acceptability, market potential, commercial viability, environmental impact, etc.

Ammonia, fertilizer, refineries & methanol - Are the largest sectors with existing use of hydrogen (5- 5.5 MTPA). These sectors hold maximum potential for green hydrogen where the current Steam Methane Reforming (SMR) process could be replaced by electrolysis or carbon storage tanks could be introduced at sites for low carbon hydrogen production.

Mobility – Shipping, aviation, rail, and long-haul trucking may see some global adoption considering the high energy density of hydrogen. It is unlikely that we see any such adoption before 2030 in India. As electric vehicles gain momentum in India, it is unlikely that the country will experience any adoption of fuel cell vehicles in the passenger cars segment. The power-hydrogen-power efficiency is quite low (~30 percent) to effectively scale up the adoption.

Hydrogen as energy storage - Decentralized use of hydrogen in remote and cold areas (J&K, Ladakh, North-East India) can potentially unlock additional demand for Hydrogen by substituting diesel as an energy source. Widespread adoption may not be a near-term possibility due to low power-hydrogen-power efficiency.

Steel and cement – Hydrogen can potentially be used as an alternative energy source and oxidant in the Steel and Cement sector. Adoption may be delayed due to technical challenges and its commercial implications. There are process and layout-related changes, which need to be undertaken for any adoption of green hydrogen in the industry, which further accentuates the unfavorable cost economics associated with green hydrogen.

Directionally encouraging green H2 policy

India launched its landmark Green Hydrogen Policy in February 2022, aiming to boost domestic production. The policy has primarily focused on bringing down the cost of green hydrogen, and improving the ease of setting up new green hydrogen/ammonia projects. The policy provides conducive measures around open access to the inter-State transmission system (ISTS), facilitating ease of doing business by implementing single-window approval for all statutory clearances required, hassle-free land allocation, encouraging export, possibility of aggregating green hydrogen demand, etc. This is directionally encouraging for the investors, considering more announcements could be in the fray.

The next phase of the policy announcements should cover some of the key areas, such as demand mandates for certain industries, associated subsidies if any, production-linked incentives for domestic electrolyzer manufacturing, direct export incentives, and measures to bring down the cost of renewable energy, which is 55-60 percent of green hydrogen production cost (1kg hydrogen consumes 53-54 kWh of electricity).

Alliances and partnerships

In the last few months, Indian Central Public Sector Undertakings (CPSUs) and a few private sector players have taken several initiatives to propel the hydrogen economy – As per media reports, major players include Indian Oil, GAIL, BPCL, NTPC, L&T, Reliance, Renew Power, ACME Cleantech, Greenko Group, etc. Alliances have been formed across the value chain and innovative business models have been worked out to plug in the gaps and address the entire value chain integration. Lately, we are seeing interest from private players in the green ammonia segment, which appears to be a promising option for long-distance shipment and transmission of hydrogen.

Targeted policy interventions

While directionally, India is poised to lead the hydrogen-led decarbonization drive, it needs to be targeted and well-defined policy measures for transitioning green hydrogen/ammonia from a niche player to a widespread energy carrier. There are barriers to green hydrogen adoption, and policymakers need to address the barriers specific to the sectors where green hydrogen is expected to be deployed. Government policy needs to focus on five critical areas:

- Demand creation by bringing policy on 'Green Hydrogen Purchase Obligation' for end-use industries. For example, a 10 percent obligation in the petrochemical and fertilizer industries can create a green hydrogen demand of 0.5 – 0.6 MTPA. This needs to be accompanied by appropriate subsidy support to fund the viability gap.

- Creation of a local manufacturing eco-system by providing production-linked fiscal grants to electrolyzer manufacturers at the initial stages. Electrolyzer manufacturing has a high potential for indigenization (up to 80 percent as per Deloitte estimates).

- Development of a well-defined regulatory framework identifying the roles and responsibilities of all actors from the Center, States, and the industry. For example, the policy may consider identifying a nodal agency to auction green hydrogen projects in the coming days.

- De-bottlenecking of infrastructural challenges and creation of a technical standard for hydrogen ecosystem, such as blending of hydrogen in gas pipeline

- Putting in place an appropriate framework to support R&D, demonstration, and deployment of green hydrogen projects through government funding and public-private partnerships