COVID-19 and its impact on solar and storage sector

The spread of COVID-19 poses a serious challenge to the momentum picked up by the solar power and energy storage sector in India, but in the long term, the crisis could help catalyze innovations and reaffirm commitment towards energy transition.

The outbreak of coronavirus disease 2019 (COVID-19) has emerged as the worst humanitarian crisis of our times. It has impacted people and businesses across sectors including solar power, energy storage and electric vehicles—both in India and globally. The outbreak is estimated to cost global economy $360 billion, four times more than that of the SARS outbreak in 2003.

The virus that was first reported in mainland China in December last year, resulted in disruption of global supply chains like none other. Factory shutdowns, travel ban and nation-wide lockdowns to contain the spread of the virus in China resulted in delayed supplies of essential raw materials creating a supply and demand gap, concerns over project completion for developers and disruption in daily operations and management of manufacturing plants worldwide.

But with the virus intensifying in India, and a complete lockdown in the country until May 3, 2020, the concerns have shifted from supply-side to the demand-side of the business.

COVID-19 to slow-down solar installation

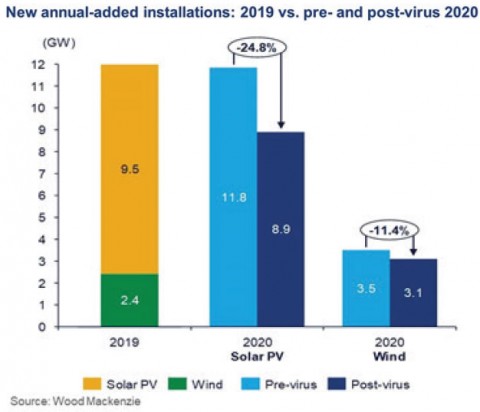

India's renewable installation could fall by a fifth due to the lockdown as per the latest projections by Wood Mackenzie. India could face over 24.8 percent or about 3GW of solar photovoltaic (PV) installations delay as a result of the country's lockdown, the report added.

At present, most of the utility-scale grid-connected solar energy projects in India are implemented by the private sector developers. The solar PV installation will be the hardest hit as the industry relies heavily on Chinese cells and PV module imports – 80 percent of the total volume. In fact, solar modules account for 60 percent of the total solar project costs.

Speaking of the impact on the solar energy sector, Deepak Thakur, CEO of Hybrid and Energy Storage, Sterling & Wilson noted that "for renewable energy businesses whether solar or storage, China is an epicentre of sourcing, and stoppage or delay in supply of key components is emerging as a major challenge for projects being executed globally."

Mr Thakur explained that project negotiations and contract signings are being delayed due to travel embargoes and lockdowns. Commenting on the impact on business operations, he added that the pandemic was causing delay in crucial decision-making and in some cases, actions, which will impact growth and profitability of businesses in the medium term.

Since the supply chain crisis coincided with the Chinese New Year, a majority of the large Indian module manufacturers had built-up inventories and could manage operations in the month of February despite delay in supplies from the Chinese vendor. However, by mid-March, the supply chain from China resumed to normalcy by 40-50 percent but India by then went under lockdown bringing production to a standstill.

"Effectively the whole first quarter has been badly hit," shared one of the largest solar PV module manufacturing company in India.

Further, to make matters worse, in the last week of March, the Indian rupee depreciated against the dollar surging past `76, making imports more expensive.

"Global crisis first impacts the currency value," said Anshul Gupta of Okaya Power Group, a leading Li-ion battery provider in the solar storage and EV sector. "If rupee goes weaker it impacts even before we talk about supply chain, and in current times a weakened rupee certainly impacts."

While COVID-19 is expected to have a potential impact on overall solar industry, rooftop solar segment in particular, experts believe, will see the most immediate impact and may end up having a longer road to recovery.

This is because in the current lockdown conditions installers cannot physically examine the rooftop solar installations capacity required by the client nor install new systems. Additionally, there will be a decline in demand, as consumers and businesses will be unlikely to take a decision on rooftop solar installation since it's not an urgent need amid the crisis, and securing loan from bank could potentially get tighter. These factors could hinder India's ability to meet the solar rooftop installation target for FY 2019-20.

As for the outlook for RE companies, experts point out that smaller rooftop solar companies which work on OPEX models are likely to be worst hit. Unlike large GENCOs, these players will not be able to sustain the cashflow disruption unless certain safeguards are put in place by the government.

Govt battles the impact on solar sector

Taking stock of the evolving situation, the government through the months of February and March announced a slew of measures to mitigate the impact of COVID-19 outbreak. Some of the significant measures announced by GoI are as follows:

March 23 – The Ministry of New & Renewable Energy (MNRE) notified that all the renewable energy implementing agencies (SECI, NTPC and others) will treat delay on account of disruption of the supply chains due to coronavirus in China or any other country, as Force Majeure. All project developers were requested to make applications to implementing agency in this regard.

March 27 – Ministry of Home Affairs exempted movement of personnel and equipment, related to power generation and transmission, from the country-wide lockdown. The ministry designated power generation (including renewable power generation) as an essential service.

March 27 – MNRE granted extension of commissioning deadlines to all RE projects under construction on account of COVID-19.

April 1 – Solar Energy Corporation of India (SECI) requested all State distribution companies (DISCOMs) and agencies to allow submission of invoices digitally.

April 2 – MNRE issued clarification regarding payments to Renewable Energy Generating Stations (REGS) by DISCOMs during the moratorium period by the Ministry of Power. MNRE stated that payment to REGS to be made on a regular basis throughout the lockdown period and grant REGS 'must-run' status.

In a major relief, MNRE notified solar project developers that time extension in scheduled commissioning of renewable projects due to the disruption of supply chains will be treated as a 'force majeure' event. This was a welcome move for the solar power sector, in absence of which, 3 GW of solar projects worth `160 billion were at risk of penalties for missing their commissioning deadlines, according to CRISIL Ratings data.

In addition to these government measures, the Reserve Bank of India (RBI) too, announced a three-month moratorium for all borrowers on both, term and working capital loan to help corporates and consumers struggling with inadequate liquidity.

Expert suggests, in addition to the extension of project deadlines, moratorium on loans and push for digitalization in transaction, the government could consider encouraging domestic manufacturing and modifying sourcing strategy for raw materials. Domestic manufacturing can help control the impact of external disturbances, and diversification of supply chain country-wise and manufacturer-wise could help in the longer run.

The government of India has set a target of installing 175GW of renewable energy capacity by the year 2022, of which 100GW will be generated from solar power. CII report on coronavirus and its impact on Indian solar industry estimates that output will suffer until around the middle of the year, but if it is contained by June, recovery might kick in starting the third quarter.

Corona constrains energy storage sector

China, which is known to have a lion's share in Li-ion battery supply, controls a whopping 70 percent of global EV battery supply. Experts project that the coronavirus outbreak could lower the output of Chinese battery manufacturers by around 26GWh by 2020, which is an estimated 15-18 percent drop in global battery supply.

In India, the disruption in supply chain has an immediate impact on both lead-acid and the Li-ion battery manufacturing companies. The impact of supply-chain disruption on Li-ion battery makers was short-lived as most companies had stocked up Li-ion cells, separators and other supplies on account of the Chinese New Year.

"Operations were affected by about 50 percent for the month of February," said Samrath Kochar, CEO of Trontek Group Pvt Ltd, an emerging Li-ion battery manufacturer in India. "Everything is in control now, but we had to move some shipments by air to cover the time lost."

Like Trontek, a number of battery manufacturers could tide over the disruptions despite the supply-side delays as they had built up inventory to last, however an increase in logistic cost and time did result in cost overruns.

For battery giants like the Amara Raja Group, though none of their supplies were directly impacted, the company had already put in place a mitigation plan working ahead with their supplier base.

"We had the luxury of having first right of access to some of the stocks based on our relationship with vendors," said Vijayanand Samudrala, CEO of the Amara Raja Group. "So, we could mitigate that."

However, Mr Samudrala cautioned that "if this (COVID-19 spread) continues and the problem becomes bigger domestically, more than shaking supply confidence we might see problems with internal logistics."

Even as supply-side challenges are easing, travel embargoes, factory shutdowns and manpower migration in India has created a second wave of challenges for both Li-ion and lead-acid battery manufacturers. Experts point out that demand for batteries is expected to fall, and cost of the product is bound to increase.

There are two primary factors driving up cost: first, land transportation in India will remain challenging in the coming months as essential supplies will compete with non-essentials resulting in increased logistics time and freight cost. Second, even after the lockdown is lifted, it will take minimum 3-4 months for the factory to return to 100 percent production capacity as it will take substantial time to remobilize workers and reskill new ones and institute new hygiene standards in the factories. As a result, some of this increased cost which will get passed on to the end consumer.

As for lead-acid battery manufacturers, a prime concern amid the crisis has been the stock of batteries getting discharged.

"Battery stocks kept in the companies' warehouses for a period of 3-6 months stand the risk of getting discharged. Some may even get sulphated, causing early failure, warranty claims and unnecessary financial loss," said Debi Prasad Dash, Executive Director - India Energy Storage Alliance (IESA).

Apart from energy storage, lead-acid batteries are commonly used in telecom, renewable integration, commercial and industrial backup, and with a fall in demand, all the above verticals are also likely to experience a negative ripple effect.

Mr Dash underscored that without appropriate government intervention many domestic lead-acid manufacturers, Li-ion assemblers and ecosystem players (SMEs and MSMEs) will face severe financial crisis and a quarter of those may have to permanently close shops.

However, the silver lining in the current crisis is that it has brought back into focus the need for localization of Li-ion cells.

"Energy storage and EVs have importance for national energy security and we should learn from the recent events and accelerate our efforts for building domestic capabilities," said Dr Rahul Walawalkar, President of India Energy Storage Alliance (IESA).

Dr Walawalkar stressed that while the Indian battery pack manufacturers are assembling high capacity packs with the goal to target electric vehicles and stationary storage market, it was high time for the industry to take up R&D and advanced cell manufacturing to reduce dependence on other countries.

As for the EV industry, even before COVID-19 EV growth had been slow to pick up due to a host of factors such demand risk, technology risk, supply chain dynamics, infrastructure concerns. But post the pandemic, EV industry's medium term and long term future remains open to multitude of scenarios.

Experts forecast that global EV sale could plunge by 40 percent, and the domestic market could experience a 10-20 percent slow-down due to supply chain disruptions of Li-ion batteries, auto components and other electronic goods. The fall in oil prices, too, does not spell good news for the sector as buyers could prefer purchasing internal combustion engine vehicles over the costlier electric alternatives.

As per SMEV, a group representing Indian manufacturers of EVs about 15 percent of EV dealers in India could shutdown post the lockdown. Most EV dealership being small operators with meagre or no backup capital support, the crisis could impact their very survival.

The spurt which was once seen in purchase of EVs post the announcement of FAME-II scheme could potentially see a drop. However, what that quantum decrease would be on the entire industry remains to be seen.

Conclusion

There is no doubt that supply chain disruption and financing gaps will have an impact on solar installation, storage capacity addition and the sale of EVs. However, the crisis also brings an opportunity for all stakeholders to reflect on ways to navigate the crisis, course correct, and take action to become more nimble and resilient for the future.

Akshay Kashyap, MD - Greenfuel Energy Solutions Pvt Ltd, suggests three-fold way to tide through the current crisis – stress-testing balance sheet for the worst scenario of demand drop and delay in account receivables, reducing variable expenses to maintain strong liquidity, and showing solidarity with employees in times of crisis by retaining talent.