The world of energy storage: Rebooting the normal

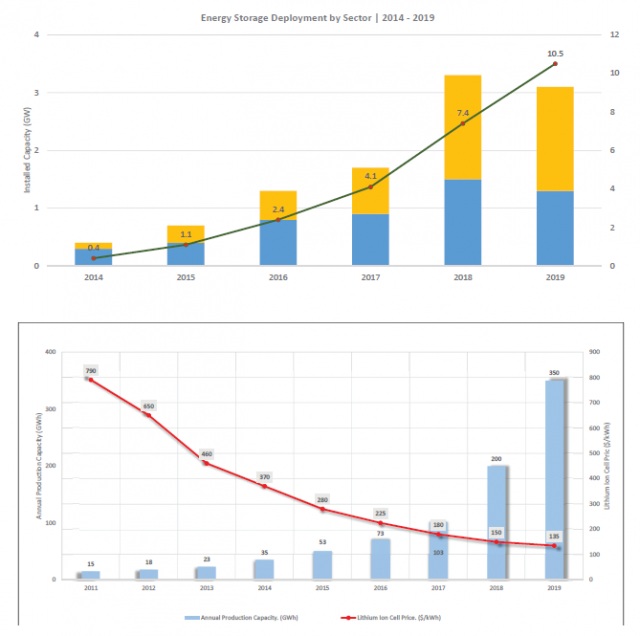

The world crossed 10.9GW of installed capacity of energy storage by the end of 2019. As battery energy storage continues to effectively integrate high shares of solar and wind in the power systems and EV uptake grows, energy storage will be foundational for a modern, clean, and reliable future.

Energy storage as a technology has evolved significantly over the last one decade. The technology, which up until a few years ago was dominated primarily by pumped storage, has seen entrants of many more competent technologies in the value chain. In terms of cumulative installed capacity, the world crossed 10.9GW of installed capacity by the end of 2019. China, Korea, Germany and USA remain the leaders in the race. In Korea, the main demand is seen coming from Commercial and Industrial segment behind-the-meter (BTM) markets, while in China the main demand enabler is grid-scale storage for RE integration and optimization. Japan, presently the global market leader in BTM sales sees continuous growth in the market (policy rewards the export of self-produced power to the grid), whereas in the US which has set short-term grid-scale targets of more than 20GW has witnessed growth in connection to achieving the same. California has been a pioneer in the game (> 10,000 BTM installations-citing grid resilience and wildfires). Europe has also shown promising growth with strong long-term support and defining storage as entity separate from generation.

Growth projection

Strong expansion of renewables, advantage of scale of economics in batteries from EV adoption, demand-side management and strong policy incentives are the key drivers in the forecast. Going by forecasts, from around 10.5GW at the end of 2019, global installation is projected to see an exponential rise to reach 1100GW by the end of 2040. The top applications include – peak demand supply, energy shifting with RE integration, ancillary services and BTM markets. In terms of market, the most significant growth is projected for India, Germany, Latin America, South-east Asia, France, Australia, and the UK.

The drop in prices of lithium-ion batteries have been the talk of the decade, making it the market leader in terms of deployment of energy storage technologies as on today. The last decade saw a decrease of 87 percent in cell level prices. Today, the average price is around $135/kWh. This is expected to reach below $100/kWh by 2025. This drop of prices comes from the increased penetration and application of Li-ion batteries in EVs which forms the major portion of the demand pie along with the emerging market for Li-ion batteries in the stationary storage arena. As seen from the graph, the total manufacturing capacity of cells was around 350GWh by the end of 2019, and the same is projected for another exponential increase with many prominent players entering the market along with established players like Samsung, Contemporary Amperex Technology, Panasonic, LG Chem to name a few. According to Bloomberg New Energy Finance, as of the beginning of 2019, China was producing 73 percent of all lithium-ion batteries globally, followed by the US with 12 percent. The forecasted installed capacity of the battery storage systems will increase 122 times by 2040. It will reach 1100GW while a total capacity, not considering pumped hydro, will reach 2850GWh.

ES technologies

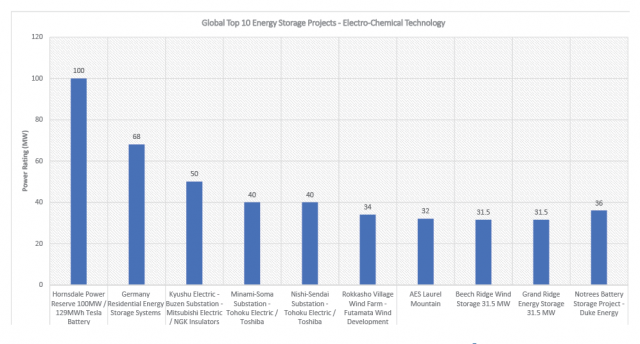

The energy storage space predominantly has been dominated by pumped storage with the largest installation (operational) sized at 3GW in Virginia, US. There are other technologies, too, that have gained ground. One such is the flywheel project in the State of Oxfordshire in the UK, constructed in 2006, supplying 400MW of power from two flywheels. The other is the biggest compressed air project by Bethel Energy Centre of rated capacity of 317 MW in Texas, US. Other technologies like thermal storage has also seen significant installations with the largest installation at Solana solar generation plant of 280 MW capacity in Arizona, US built in 2013. Besides these technologies which are quite mature in the energy storage domain when we talk about electro-chemical energy storage technologies, we have witnessed significant growth in the last decade.

The graph below shows the top ten projects utilizing electro-chemical modes of energy storage technology across the world, with the largest of such projects being in Australia, the Hornsdale Power Reserve Project of 100 MW capacity for 1.28 hrs. The same is now also approved for expansion. Along with these there have been some bigger projects which have been announced, one such is from Dalian, China, which will be the largest vanadium flow battery in the world with a 200MW/800MWh capacity. It is being developed by Rongke Power Co. Ltd. and UniEnergy Technologies (UET). If the regulatory bodies give permission in 2020, Strata Solar will build a 100MW/400MWh energy storage station in Oxnard, California. The project is expected to start in December and will be connected to the largest system of lithium-ion batteries in the world.

Pacific Gas and Electric has secured permission from local regulator for construction of the largest battery system in the world. Its capacity will reach 567.5MW/2270MWh. The system will include four separate projects. The first one will be built by Vistra Energy at the existing power station and have the capacity of 300MW/1200MWh. The other project built by Tesla and operated by PG&E will provide 182.5MW/730MWh from the local substation. All projects are expected to be commissioned by the end of 2020. They will replace three peak gas-powered stations.

RE plus storage

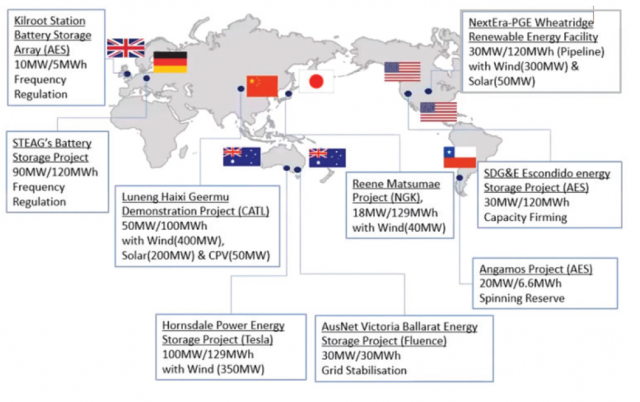

One of the major areas that has witnessed significant growth is the integration of storage along with renewables across the grid. RE with storage makes a very strong proposition as storage helps in making renewables much more reliable and helps to propel further growth of renewables in the global energy grid. With the increasing penetration of renewables, the world will also require a buffer to take care of the dynamics which renewables bring to the grid and thus energy storage becomes even more important. The same is seen as much beneficial too, as with renewables the overall cost of storage at project level is further reduced due to pooling of resources like substation, grid infrastructure, inverters, etc.

Looking into some of the largest projects of storage coupled with renewables, the same is quite well distributed across the globe (as can be seen in the world map).

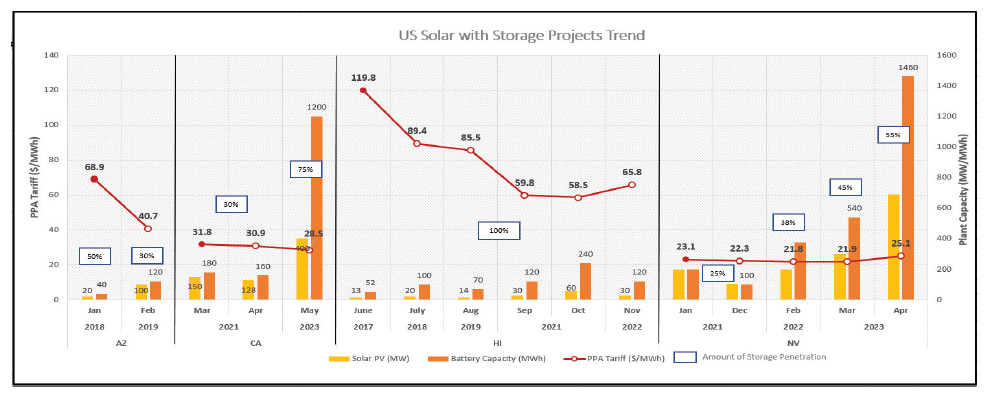

The growth of integration of storage with renewables, especially solar will be a journey that will traverse faster than we can even imagine. To give an example, around one third of solar projects planned in the U.S. are coupled with storage, that itself is quite noteworthy. By the end of 2019, there were more than 367GW of solar plants in the U.S. Interconnection queues, of which 102GW (around 28 percent) are hybrids, most typically pairing photovoltaics with battery storage, and about 5 percent of the 225GW of wind projects in interconnection queues include storage (11GW).

Along with this, EDF Renewables is planning to build a 200MW solar plant with a 180 MW/720 MWh battery for Nevada utility. Many such announcements and commitments have been made over the last year. In fact, beating through the pandemic, U.S. set record installations in battery storage in the first half of 2020. What has been noteworthy here is the decreasing PPA costs for U.S. solar with storage projects, even with increasing percentage of penetration the cost has been seeing a downward trend with 15 percent drop just in between 2018 and 2019 signed PPA prices. To give an example, A four-hour battery that is sized at roughly 25 percent of the PV capacity adds about $4/MWh to the overall PPA price. But as the battery capacity increases to 50 percent and 75 percent of the PV capacity, the levelized storage adder increases linearly to ~$10/MWh and ~$15/MWh, respectively.

Battery storage for EVs

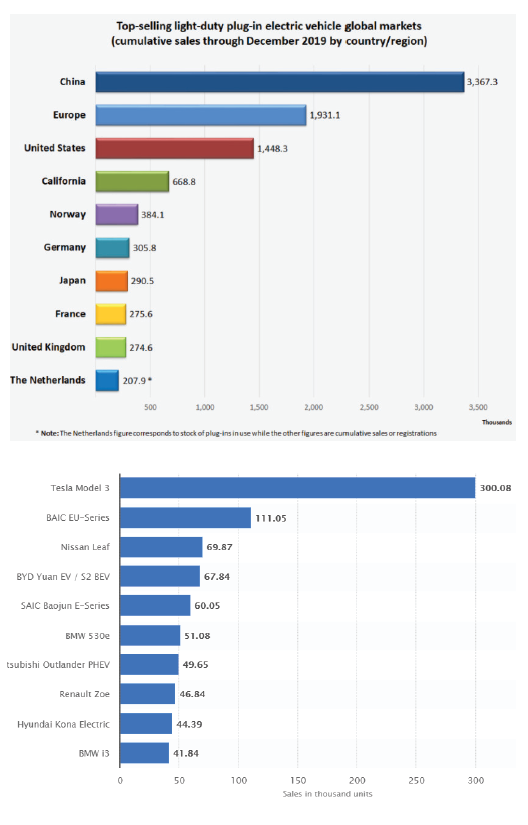

Talking of energy storage, especially batteries, we need to talk of the main enabler which has made batteries, specially Li-ion so competitive with respect to its other competitors in market. More than 50 percent of the present demand of Li-ion comes from its need in EVs. Let us, therefore, focus a little on what has been its impact on the global automotive sector. Today, there are more than 7 million passenger EVs on road worldwide (i.e. around 3 percent of total vehicles globally), with around 2.1 million of them added in 2019. The share of commercial EVs in this is slowly increasing with many e-commerce players shifting to EVs for deliveries, across the globe. The percentage of electric buses in the same is also showing much promise (> 500,000 today). China has been the undisputed leader in the EV frame, from manufacturing to sales. China is followed by Europe and South Korea, with U.S. being a close fourth. Due to greater adoption and supportive government policies in the forms of incentives, subsidies and phasing out Internal Combustion Engine vehicles (13 countries and many municipalities have already announced), we see price parity coming faster in Europe, U.S., and China. Europe's CO2 regulations and China's EV Credit System makes both the countries together make up for more than 50 percent of the EV market.

Growth of EVs

At present, there is a mix of BEV (battery EV) and PHEV (plug-in hybrids EV), in the long period the share of PHEV will slowly decrease giving way for a BEV dominated front. There are other new entrants too, like fuel cell vehicles, but projections show that FCVs can make a mark in the global vehicle share post 2030. By 2040, FCVs can form around 1 percent of total vehicles on road. The world can have around 30 percent of its vehicles as electric (in various forms) by 2030. This also means that there will be a considerable rise in the demand for electricity with the increasing demand for EVs.

BNEF report indicates that by 2040, electrification of transport can add up to 5.2 percent to global electricity demand. In terms of sales, Tesla topped the world as the best-selling EV brand in 2019, followed by BAIC and Nissan Leaf (Statista). According to EV-volumes.com, 2.21 million EVs were sold in 2019, increasing 10 percent year-on-year. And the market share of EVs grew from 2.1 percent to 2.5 percent, which means there was one EV for every 40 cars sold in the world last year. BNEF projects that by 2022, there will be around 500 EV models globally. Due to the pandemic, the 2020 sales are projected to dip to 1.7 million, but the same will pick up by 2025, reaching 8.5 million.

Overall, this sector promises to display continuous development, increase in penetration, along with a decrease in cost. This is just the beginning and this sector is yet to witness its full-fledged growth phase in the coming years. A closely linked critical development in the battery world is hydrogen. Hydrogen has been makings strides in its own game to challenge batteries in the coming years. It will all depend on how well all the technologies currently present keep updating and improvising, while remaining sustainable and competitive over the longer run.