No looking back: Energy transition in Middle East-North Africa (MENA) region

In many ways, this year was the tipping point for renewable energy. The world has woken up to the imperative of energy transition, and countries around the world have made progress on this front, albeit in different degrees. We take stock of their situation in this multi-part series.

Energy Storage

Claimed as one of the highest-potential regions for renewables and energy storage in the world, the Middle East and the Africa have just began exploring their possibility of unlocking the region's natural and geopolitical advantages in this regard. Storage projects are becoming key factors in achieving RE targets in this region, especially in countries such as Jordon, Israel, Morocco, UAE, Saudi Arabia, and so on.

The prime drivers of energy storage in the region are as following:

- Intermittency in solar and wind power generation warrants robust energy storage systems in place for reliable and consistent energy supply

- Demand for grid improvements and control of load-shedding across vast and remote areas of the region fuels the critical need for energy storage

- Push from power utilities and government policies to invest in battery storage, as in countries such as South Africa and Israel

- Interest shown by private sector IPPs in energy storage

- Ease in lending by DFIs and commercial banks for energy storage projects under RE sector

As per a recent report by Arab Petroleum Investments Corporation (APICORP), about 30 energy storage projects are planned in MENA region between 2021 and 2025 with a total capacity of 653 MW / 3,382 MWh.

Pumped hydro storage (PHS) and electrochemical energy storage, Sodium-Sulphur (NaS) and lithium-ion batteries in particular, are the preferred technologies in the region. The storage duration hovers between 32 minutes and 2 hours for li-Ion batteries, 6 hours for NaS batteries, and 10 hours in the case of thermal storage.

The share of battery energy storage is expected to jump from the current 7 percent to 45 percent by 2025, APICORP report adds.

A fair share of ES projects, both planned and already operational, are coming up in the GCC (UAE, Saudi Arabia, Qatar, Oman), North Africa (Egypt, Morocco, Algeria and Tunisia), and some key projects in the Levant (Jordan, Iraq and Lebanon).

Some of the key developments in ES projects in 2023 are as following:

- Israel has announced 800 MW/ 3,200 MWh BESS buildout comprising four facilities of 200 MW and 4 hours' storage duration each in the northern Gilboa mountain range region.

- West Africa's first BESS project (16 MW of solar PV with 10 MW/ 20 MWh) dedicated to frequency regulation is coming up in Senegal – the largest BESS in the country as of now.

- Masen is undertaking Noor Midelt III solar-storage project with 400 MWh of BESS capacity in Morocco – the largest energy storage project in the country.

- Ncondezi Energy has secured land agreement for 300 MW solar-cum-storage project in Mozambique early this year.

- South Africa has floated RfP for 513 MW of battery storage early this year.

- Sungrow to build 536 MW/ 600 MWh BESS for ACWA Power in Neom smart city in Saudi Arabia.

- Emirates Water and Electricity Company (EWEC) has called for 300 MW/ 300 MWh of BESS capacity in UAE in the next three years.

E-mobility

The year 2023 is considered as pivotal period for the MENA region in embracing e-mobility. Investors are identifying unique opportunities to capitalize the emerging EV space, which is seen as a corollary to the emergence of RE, energy storage, and smart grid initiatives in recent times.

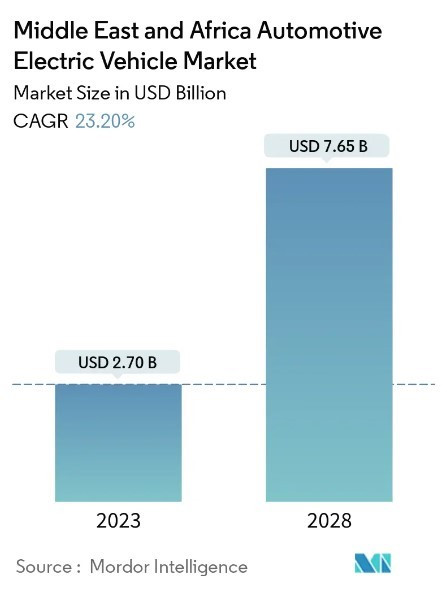

The Middle East and African EV market size is expected to grow from $2.70 billion in 2023 to $7.65 billion by 2028, at a CAGR of 23.20 percent, predicts Mordor Intelligence.

Some of the critical factors influencing the region's transition to EVs are as following:

- Abundant solar and wind energy potentials that can support a vibrant EV ecosystem

- Change in policy focus of governments in the region to promote the use of EVs with tax incentives

- Rising government initiatives to build charging infrastructure

- Sub-Saharan African (SSA) countries burdened with fuel dependency and subsidies are in urgent need of alternative energy sources for transport

- Startups and incubators are showing high interest in new business models

- Western electric car markets are showing interests to enter the premium markets in the region

Leading countries in this emerging EV endeavor in the MENA region are Turkey, Israel, Jordon, UAE, South Africa, Saudi Arabia, and Egypt. Here are the latest developments in this regard:

- UAE has revised its national EV policy with a target of achieving 50 percent EV penetration in total vehicles by 2050. The country also plans to build 914 AC and DC charging stations for electric vehicles by the end of 2023.

- Dubai has vowed to increase the city's network of public charging stations by 170 percent in the next three years – from 370 points currently to 680 by 2025.

- Israel has registered a 10 percent rise in EV sales in the first half of 2023 as against last year.

- Turkey is fast-emerging as an EV manufacturing hub in the Middle East, with global OEMs like Ford, Toyota, Hyundai, and Renault establishing JVs for EV assembly to cater to local and export markets.

Green Hydrogen

The COP27 held in Egypt last November kick-started a pivotal moment for green hydrogen investments in the MENA region. A slew of announcements in the past one year have put the region under the spotlight, thanks to a combination of factors such as rising global demand (especially for Europe), cost reductions via innovation, and pre-existing conditions suitable for production and transportation of green hydrogen.

At present, over 46 green hydrogen and ammonia projects across Middle East and Africa has been identified, with an estimated total budget of more than $92 billion. Although the current active hydrogen capacity is just 0.2 million tons per annum, reports predict a huge capacity expansion in the coming years owing to export potential.

According to MEED, the demand in Europe alone is forecast to double to 30 million tons a year by 2030 and to 95 million tons by 2050. With the scaling up of European investments in the region's hydrogen landscape, a vast majority of this demand is likely to be fed by the green hydrogen produced in MENA region.

Leading countries in the hydrogen rush in the region are Egypt, Mauritania, Oman, Kenya, the UAE, South Africa, Namibia, Qatar, Saudi Arabia, and Bahrain. Some of the key developments in MENA's green hydrogen landscape in 2023 are as following:

- At COP27, Egypt garnered nine projects worth $83 billion, with a capacity to make 7.6 million tons of green ammonia and 2.7 million tons of green hydrogen per year.

- UAE has announced two hydrogen production hubs called as 'oasis' by 2031, with a production target of 1.4 million tons of green H2 per year by 2031 and 15 million tons by 2050.

- Saudi Arabia's NEOM Helios – claimed as the world's largest green hydrogen plant – has concluded EPC agreements with Air Products and other agreements with financial institutions. The project under construction is scheduled to become operational in 2026.

- Oman Acme Group green hydrogen hub to produce 2,400 TPD of green ammonia with an annual production of 0.9 million tons became operational.

- ACWA Power, OQ, and Air Products have invested on a world-scale green hydrogen-based ammonia plant in Oman. Preliminary work for the construction of the facility has started.

- Marubeni Corporation and Saudi Arabia's Public Investment Fund (PIF) are conducting a feasibility study for producing clean hydrogen in the country for export markets. PIF is already working on another green hydrogen project with POSCO, finalized in 2021.

- Hyphen Hydrogen Energy has announced the next phase of a $10 billion green hydrogen project that is coming up in Namibia.

To see other articles in this series, click here.