No looking back: Energy transition in India

In many ways, this year was the tipping point for renewable energy. The world has woken up to the imperative of energy transition, and countries around the world have made progress on this front, albeit in different degrees. We take stock of their situation in this multi-part series.

The Government of India has set a target of achieving 500 GW of renewable energy by the year 2030. This should provide a fillip to the energy storage sector, as penetration of RE in the grid necessitates energy storage systems for grid balancing. Further, the Ministry of New and Renewable Energy has indicated that it is considering all future renewable tenders with inclusion of energy storage.

India's Central Electricity Authority (CEA) has modeled a need for 27 GW/ 108 GWh of battery storage by 2030 to meet the national demand, while battery storage could be an export opportunity as well.

Developing markets like India, Brazil, and South East Asia are expected to continue registering higher y-o-y growth rates in EV sales, although the markets are largely limited to low-end E2Ws and E3Ws and volumes are relatively lower than that of developed markets or conventional (ICE) vehicle sales in those markets. India registered one-million-unit annual sales for the first time in 2022, with 2023 opening with a better monthly average in the first quarter. The country FAME II incentives to EV buyers are available till March 2024, which can act as a further boost to increase pre-buying this year. India is also expected to see higher adoption of electric buses this year, as industry experts predict fresh tenders by state-owned operators.

Energy Storage

In FY 2022-23, India generated 203,552 million units (MU) of renewable energy, a growth of 19 percent over the previous year, according to the CEA. India's installed battery energy storage capacity was just 20 MW in 2021, but is projected to reach 38 GW by 2030 to support the country's ambitious goal of 500 GW of renewable capacity by that year. India currently has over 160 GW of renewable energy capacity, constituting 40 percent of its total power capacity.

India is home to the world's largest solar farm, but the bulk of the country's energy storage is made up of hydroelectric power. Hydro projects, including pumped hydro, stood at 46 GW as of March 2022. Nevertheless, renewables are expected to dominate the energy mix, accounting for nearly half of the power generation capacity by 2030.

The Indian government's initiatives and the decreasing costs of lithium-ion batteries are poised to drive the growth of the India battery energy storage systems (BESS) market. A significant development is the Union Cabinet's approval of a viability gap funding (VGF) scheme for creating a robust storage system for excess wind and solar power. This scheme aims to develop 4,000 MWh of BESS projects by FY31, with an initial outlay of ₹9,400 crore, including budgetary support of ₹3,760 crore.

Some notable developments in the BESS segment include:

- Solar Energy Corporation of India (SECI) has awarded a contract for setting up a 100 MW (AC) solar with 40 MW/ 120 MWh Battery Energy Storage System (BESS) to Tata Power Solar Systems Ltd, with an estimated cost of $115 million, expected to be commissioned in the second half of 2023. The project, to be set up at Rajnandgaon, Chhattisgarh, would be one of the largest grid-connected BESS projects in the country.

- SECI has awarded another BESS project to Tata Power Solar, to be built at the Phyang village in Ladakh. The battery storage equipment for the BESS - of up to 60.56 MWh capacity, will be supplied by the ES division of Sungrow. The project is stated to include a 20 MW solar PV plant, which will be effectively work as a 50 MW AC energy resource for the region with the integration of the BESS.

- JSW Energy was awarded two storage projects by SECI, totaling 500 MW and 1,000 MWh output, providing two hours of power backup.

- Greenko Energy won a tender for a 3,000 MWh energy storage project from National Thermal Power Corporation (NTPC).

- NTPC Renewable Energy announced a standalone battery storage project of 250 MW/ 500 MWh.

- Gujarat Urja Vikas Nigam tendered a hybrid project with 500 MW capacity combined with 250 MWh of energy storage capacity.

- The Ramagiri Solar-Wind-Hybrid project, integrated with BESS, is located in Anantapur, Andhra Pradesh, and is owned by SECI.

Battery manufacturing

India is gearing up for a significant leap in lithium-ion battery manufacturing to support electric vehicles (EVs) and renewable energy. The nation aims to establish 12 giga factories by 2030, potentially turning into a net battery exporter to meet global demand. This initiative targets a massive 1,000 megawatt-hours of battery capacity, equivalent to powering 10 lakh homes or around 30,000 electric cars for a year. Current progress in the Indian battery manufacturing scenario:

- Agratas Energy Storage Solutions is setting up India's first gigafactory in Gujarat with a $1.57 billion investment for a 20 GW unit.

- Ola Electric, one of India's leading EV manufacturers is constructing a 100 GWh giga factory in Krishnagar, Tamil Nadu, with initial 5 GWh capacity. It's expected to be fully operational by the end of this year, focusing on NMC 2170 battery cells.

- Amara Raja Batteries Limited inaugurated an extensive giga factory in Telangana with an anticipated investment of ₹9,500 crore over the next decade. This facility will produce Li-ion batteries, with a capacity of 16 GWh for lithium cells and 5 GWh for battery packs.

- Exide Industries is investing ₹6,000 crore in a state-of-the-art Li-ion cell manufacturing factory in Karnataka. The giga factory will employ advanced cell chemistry (ACC) technology, with a partnership with SVOLT Energy Technology for localized manufacturing.

- Tata Group is committing an investment of ₹4,000 crore to build a Li-ion battery plant in Gujarat's Dholera Special Investment Region. This project aims for a production capacity of 10 GWh, with investments to be carried out in stages.

- Lucas TVS and 24M Technologies are collaborating to establish a giga factory in Thervoy Kandigai, near Chennai. This facility, based on semisolid platform technology, targets a capacity of 10 GWh, with commercial production set to begin by the end of this year.

- Cygni is embarking on a venture in Telangana with a giga factory capable of producing ~400,000 battery packs annually, boasting a capacity of 1,200 MWh.

- Maruti Suzuki is planning to get into Li-ion battery manufacturing through a new joint venture with Toshiba and Denso.

- Last year, Log9 Materials launched its cell production unit in Bengaluru. It claims to be India's first indigenous cell manufacturing line and the largest in Southeast Asia.

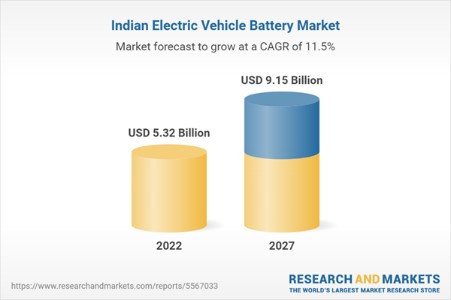

E-mobility

India is poised to become a major player in the electric vehicle (EV) market by 2030, with an estimated annual growth rate of 49 percent. The government's initiatives, environmental concerns, and rising fuel prices are driving this growth. India's EV market presents an investment opportunity exceeding $200 billion over the next decade.

According to media reports, India's EV market has grown at an impressive 55 percent annual rate since 2018, particularly in electric 2-wheelers and 3-wheelers. In 2022, the country achieved a significant milestone with the sale of 1 million EVs.

According to data from the Vahan portal, EV registrations in India surged to 10,20,679 in 2022 from 3,29,808 in 2021. As of March 2023, a total of 2,78,976 EV registrations were recorded. The Economic Survey 2023 predicts that annual sales could reach 1 crore units by 2030.

Upcoming EV Launches:

Tata Motors: The company which leads the passenger EV segment with models like Tata Nexon EV, Tiago EV, will be launching the Sierra, Curvv, Avinya, Altroz, and Tata Punch EV (expected in November 2023).

Hyundai: Offers the Kona and is set to introduce the Ioniq 5 EV.

Mahindra: Set to launch the XUV 400 electric SUV.

VW-owned Skoda: Planning to launch the Enyaq iV early next year. Volkswagen is also testing the ID.4, set to launch in May 2024.

Volvo: Launching the XC40 Recharge and plans to introduce the C40 Recharge coupe SUV in 2023.

Mercedes-Benz: Currently offering the EQC and planning to launch EQS, EQA, and EQS SUV, with local assembly in India.

BMW: Launching the i7, i4 electric sedan, and iX1 this year.

MG Motor India: Preparing to launch the MG Air EV, with locally sourced batteries from Tata AutoComp.

Citroen India: Recently introduced its first electric car, ëC3, to the Indian market.

Green Hydrogen

Hydrogen demand will be concentrated around regions with refineries and fertilizer plants. Establishing green hydrogen supply hubs near these demand centers is seen as a cost-effective solution.

India is making rapid strides toward reducing its reliance on fossil fuels and transitioning to green energy. The government aims to produce five million tons of green hydrogen by 2030, as part of its carbon neutrality target for 2070. The National Green Hydrogen Mission supports this effort by offering incentives for green hydrogen and green ammonia production.

Several private sector conglomerates and organizations are investing heavily in green hydrogen production and energy storage:

- Reliance Industries plans to set up a factory for electrolyzers and is collaborating with Stiesdal AS to develop modular electrolyzers for green hydrogen production.

- JSW Future Energy is partnering with Australian Fortescue Future Industries to produce green hydrogen for industrial applications.

- Bharat Petroleum Corp (BPCL) is planning to set up a 20 MW electrolyzer at the Bina refinery in Madhya Pradesh, in collaboration with BARC to enhance alkaline electrolyzer technology.

- Hindustan Petroleum Corp (HPCL) is setting up a 370 metric tons pilot plant at its Vizag refinery for green hydrogen production.

- GAIL (India) is building one of India's largest proton exchange membrane (PEM) electrolyzers in Guna, Madhya Pradesh, with a capacity of 4.3 metric tons per day, expected to commence operation in November 2023. It is also setting up a 10 MW PEM electrolyzer and collaborating with Gujarat Alkalies and Chemicals for a bioethanol plant.

- Indian Oil Corp (IOC) is setting up green hydrogen plants in Mathura and Panipat, in collaboration with L&T and ReNew.

- Oil India Ltd has planned a 100 KW green hydrogen plant at its pumping station in Jorhat, Assam.

- Adani Group is investing heavily, with plans to produce 1 MTPA of green hydrogen before 2030, particularly in its Mundra SEZ.

- L&T is collaborating with HydrogenPro of Norway to make alkaline water electrolyzers, with plans for significant investments in green hydrogen production.

- NTPC is working on developing a massive green hydrogen hub in Andhra Pradesh, expected to be completed in phases by 2030. The company is also involved in various green hydrogen initiatives, including blending hydrogen in natural gas and supplying green hydrogen to the Indian Army.

- ONGC is partnering with Greenko ZeroC Private Limited to explore green hydrogen and ammonia production.

- Greenko is collaborating with Belgian company John Cockerill to manufacture electrolyzers in India.

To see other articles in this series, click here.