Cleantech funding hits record, but falls short of what net zero pathways require

Last week, Brookfield Asset Management announced it had raised $10 billion for its second Brookfield Global Transition Fund – which invests in clean power technologies – and said it plans to raise more since the fund will remain open until the third quarter of the year.

The company is also looking to raise more money for another fund, this time focused on emerging markets.

Brookfield's fundraise shows there's money to be made in financing the energy transition, and should boost the spirts of Ajay Banga, the Word Bank President promoting private sector involvement in making the world carbon neutral. It also caps a year of good news for the energy transition industry, which saw inflows touch a record $1.77 trillion in 2023, indicating continued investor confidence even as cost escalations weigh down projects and developers.

Decoding the Pie

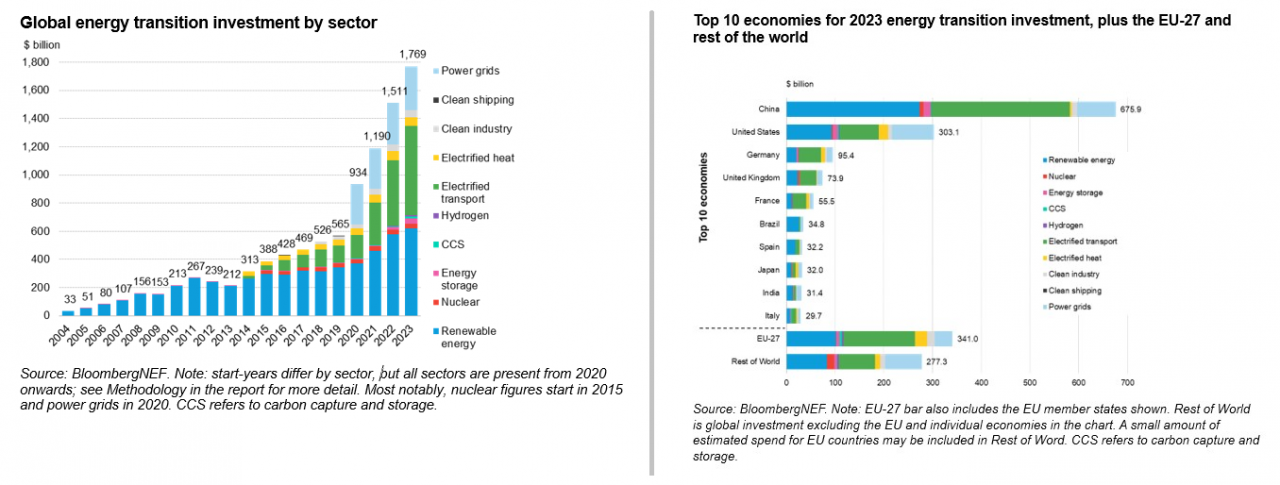

Research company BloombergNEF's Energy Transition Investment Trends 2024 report says global investment in low-carbon energy transition jumped 17 percent to an all-time high in 2023, demonstrating "the resilience of the clean energy transition in a year of geopolitical turbulence, high interest rates and cost inflation".

BloombergNEF says e-mobility (spending on electric cars, buses, two- and three-wheelers and commercial vehicles, as well as associated infrastructure) is now the largest sector in terms of energy transition funding, having cornered $634 billion in investments, up 36 percent over the previous year.

Renewables (construction of wind, solar and geothermal power plants, biofuels production plants, etc) was close behind, growing 8 percent over 2022's investment to $623 billion.

In third place came power grids, where investment reached $310 billion in 2023.

China, dominant across the renewables chain, was the largest country for investment at $676 billion, or about 38 percent of the world total.

The European Union took in $341 billion, while the US received $303 billion. Together, the EU, the US and the UK combined to receive $718 billion of investment. It was the first time since 2022 that their total exceeded China's.

The BloombergNEF report also found that 2023 was a banner year for investment in the global clean energy supply chain. Investment in equipment factories and production of battery metals for energy technologies touched $135 billion, against a mere $46 billion in 2020. Based on currently announced investment plans, this will rise further in the next two years to $259 billion by 2025.

Furthermore, clean energy-focused firms raised $49 billion in equity in 2023, more than any other sector.

Brookfield in big league

For Brookfield, the latest fundraise is a massive boost that cements its credentials in the cleantech space.

Already a leading global alternative asset manager with over $850 billion in assets under management, the new fund gives it the kind of financial muscle that is only available at the largest investment firms, such as BlackRock, or large energy companies such as NextEra Energy. At last year's UN climate summit (COP28), the UAE announced it would put $2 billion into BGTF II and up to $1 billion into Brookfield's emerging markets fund.

In all, the Canadian company is eying $25 billion of investor money, all which will go towards helping accelerate the global transition to a net zero economy.

BGTF II will be co-headed by Mark Carney, Brookfield Chair and Head of Transition Investing, who has been governor of two central banks (Canada and the UK) and a UN special envoy on climate action and finance, and Connor Teskey, CEO of Brookfield Renewable and a global clean tech leader in his own right. It will continue with the investment strategy of its predecessor fund: expansion of clean energy, acceleration of sustainable solutions, and decarbonization for companies in carbon-intensive sectors.

BGTF II's seed portfolio includes a UK onshore renewables developer and a solar development partnership in India. In a release Brookfield claimed the pipeline of further opportunities was "robust", and Carney said the investor commitments demonstrated beyond doubt "the breadth and scale of attractive investment opportunities in the transition to a net zero economy".

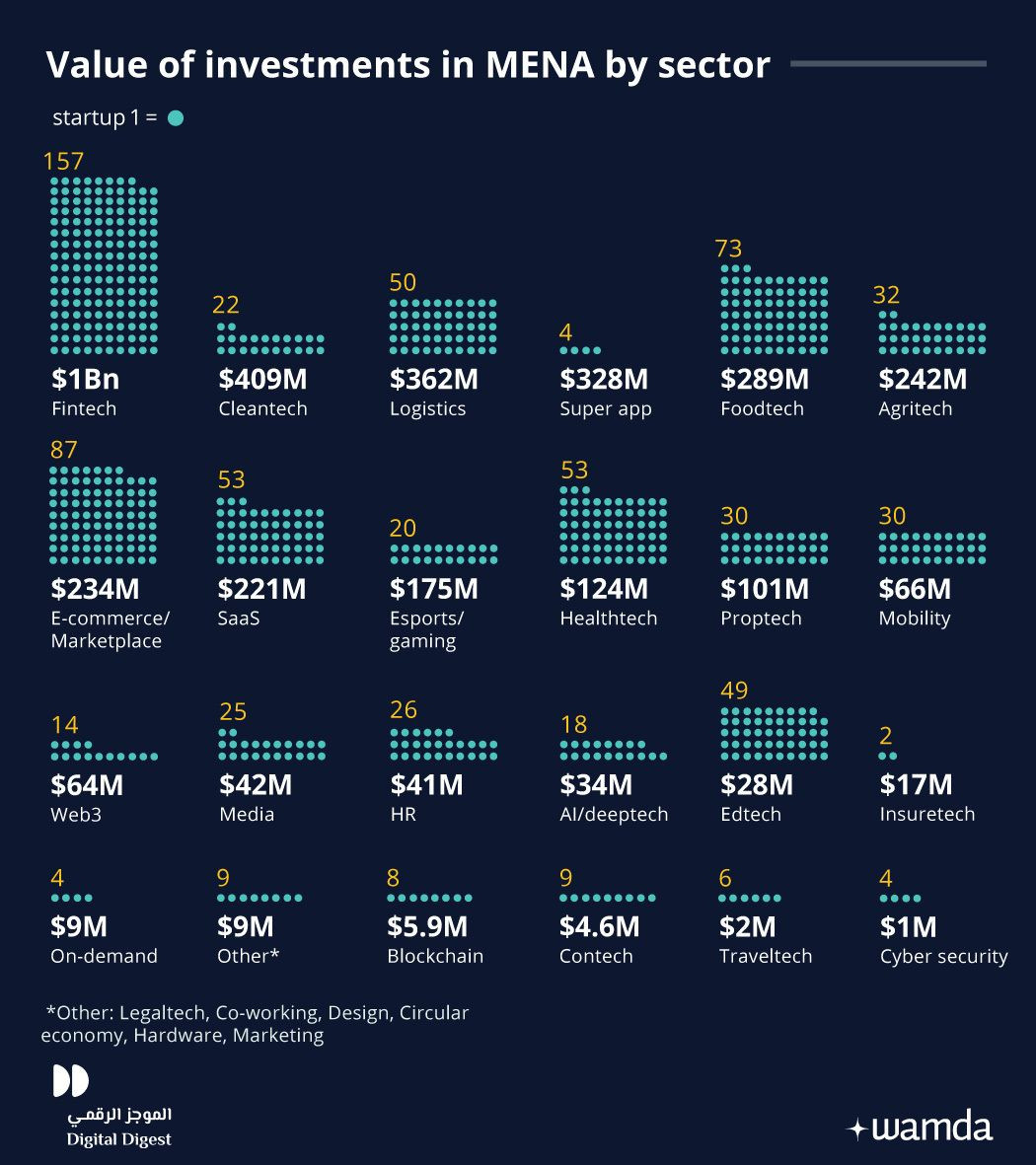

Cleantech Startups in the MENA Region -

Established blueprint

Brookfield says it has deployed over $100 billion in renewable power and energy transition investments around the world. The company boasts a renewable power portfolio spanning hydroelectric, wind, utility-scale solar and storage facilities across North America, South America, Europe and Asia, with a total installed capacity of 32,800 MW, and an additional 155,400 MW in the development pipeline.

The company's portfolio of investments spans nuclear services, carbon capture and storage, renewable natural gas, waste recycling, green ammonia and solar panel manufacturing.

Its inaugural Global Transition Fund (BGTF I), which closed with a record $15 billion in June 2022, remains the largest such fund in the world. That money is deployed across, or committed to projects spanning renewable power, business transformation, carbon capture and storage, renewable natural gas, and nuclear services opportunities.

Shortfall so far

Connor Teskey, CEO of Brookfield Renewable Power & Transition, believes corporate demand for decarbonization technologies has become the primary driver of transition investment.

Teskey pointed out the emergence of new trends, such supplying clean power to the data and technology sector, building new industrial supply chains, and scaling technologies that promote industrial decarbonization.

"The strong first close for the latest Brookfield Global Transition Fund demonstrates the growing appetite among leading global investors to capitalize on these trends," he said.

In truth, investors need to offer more: the current level isn't enough to take the world across the finish line of its net zero by 2050 target. BloombergNEF estimates global energy transition investment needs to hit $4.8 trillion – three times 2023's total – every year from 2024 to 2030 to meet the emissions reduction trajectory agreed to in the Paris Agreement.

Albert Cheung, Deputy CEO of BloombergNEF, commented: "Our report shows just how quickly the clean energy opportunity is growing, and yet how far off track we still are."

"Energy transition investment spending grew 17 percent last year, but it needs to grow more than 170 percent if we are to get on track for net zero in the coming years," he said, adding: "Only determined action from policymakers can unlock this kind of step-change in momentum."