No looking back: Energy transition in China

Energy Storage

A global force to reckon with in the energy storage and battery manufacturing, China is reportedly taking big steps this year to jack up its domestic capacities. In the first five months of 2023, the country announced new energy storage projects worth 19 GW, up by 93.5 percent from the same period last year. By 2027, China is expected to boast a total capacity of 97 GW, according to Haitong Securities Co. Ltd.

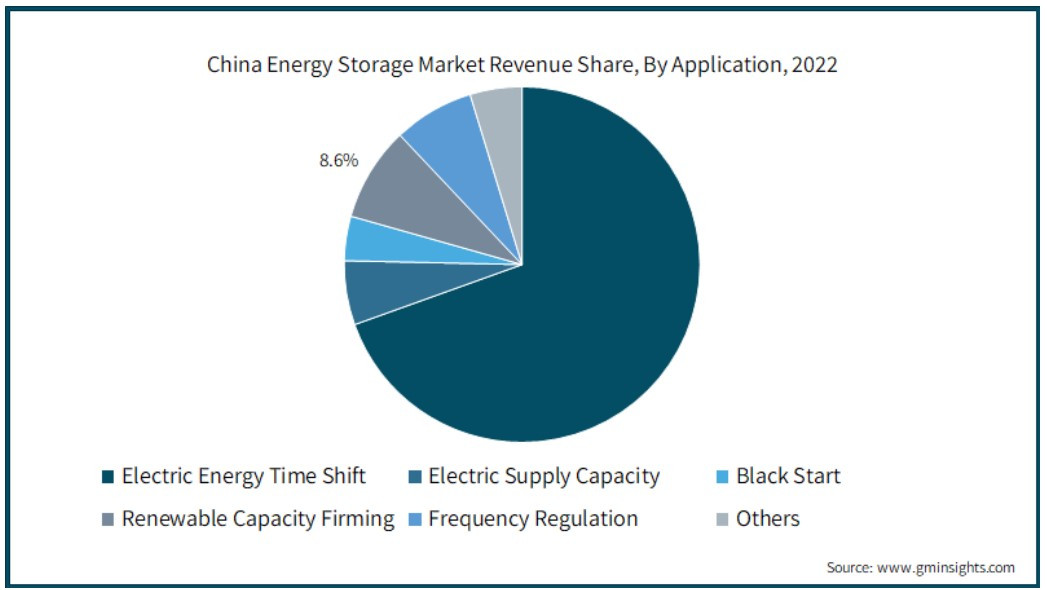

In terms of monetary value, China's energy storage market surpassed $93.9 billion in 2022, and is expected to grow at a CAGR of 18.8 percent from 2023-32. Some of the key push factors behind the country's tremendous energy storage capacity addition are as following:

- Increasing RE capacity addition requiring energy storage for seamless grid integration

- Extreme peak load demands and fluctuations in RE production

- Favorable regulatory and policy framework in place

- Increasing concerns towards energy security out of decarbonization efforts

- High potential of domestic capital market to close financing gaps for ES projects

More specifically, China's installed BESS capacity stood at 12 GW as of May this year, up more than a third from the 8.7 GW installed capacity at the end of 2022. Electro-chemical (battery) energy storage holds higher share in the country's energy storage capacity additions, led by Lithium-ion, Sodium Sulphur, Flow batteries, and others.

In 2023, China has witnessed the following project developments in the new energy storage (battery-based) market:

- China's largest BESS (200 MW/ 400 MWh), equipped with Hithium's lithium iron-phosphate (LFP) cells built for system integrator ROBESTEC has gone live in Ningxia, China, at the start of this year.

- Kehua Digital Energy has provided the country's first 100 MW liquid-cooled battery energy storage application at Lingwu over the Gobi desert with a capacity of 100 MW/ 200 MWh.

- Ming Yang Smart Energy-Tong Liao Hybrid project is expected to come online this year, a 320 MW lithium-ion BESS located in Tong Liao, Inner Mongolia, China.

- Tesla is starting the construction of its new gigafactory in Shanghai for manufacturing its large-scale BESS called 'Megapacks' for domestic and global markets.

- BYD has secured RMB 498 million ($71.6 million) contract from state-owned Yuneng Holdings to construct battery storage facilities in Henan province.

- China Southern Power Grid Company's 40 MWh BESS located in in the city of Meizhou, Guangdong province has come online. It features immersion liquid-cooling technology, first of its kind in the world, developed by Hithium.

- BYD has also signed a framework agreement with the China Electricity Council to jointly develop research projects, industry standards, and service networks for battery storage systems.

E-mobility

As the frontrunner of electric mobility in the world, China registered a y-o-y EV sales growth of 29 percent in Q1 2023. According to Counterpoint Research, China's EV sales is expected to exceed 8 million units in 2023, up from 6.9 million units sold in 2022. Pure electric vehicles (BEVs) account for nearly 70 percent of the new energy vehicles (NEVs) sold in the country, although the share of plug-in hybrid EVs (PHEVs) continue to grow this year.

Having said that, the growth of the Chinese EV market is predicted to slow down this year, thanks to the effective withdrawal of government subsidies for NEVs.

Some of the key factors determining the growth and trajectories of the Chinese EV market are as following:

- Fierce competition among automakers to achieve higher market share resulting in price war, which may make the market even more competitive

- Looming price war among the international EV players may push the emerging and start-up brands to the margins

- Government initiatives resulting in robust development of EV charging infrastructure

- China's new tax incentive package for NEVs for the next four years is expected to address the sluggish sales predictions due to the cut in already existing incentives

- As an early adopter of EVs, Chinese buyers are realizing the economics of switching to electric and hybrid vehicles, resulting in consistent demand base year after year

Some of the most important developments that has happened in the Chinese EV industry so far are as following:

- China has announced a RMB 520 billion ($72.3 billion) tax incentive package for New Energy Vehicles (NEVs) for the next four years. NEV buyers in 2024 and 2025 can save up to RMB 30,000 ($4,170) per vehicle, thanks to complete exeit mption from purchase tax. From 2026 to 2027, the exemption will be capped at RMB 15,000 ($2,078) for every vehicle purchased.

- NIO is reportedly working on its own 40 GWh battery plant at Hefei in China's Anhui province, which may go into production in 2024.

- Tesla is commencing mass production of the revamped Model 3 at the gigafactory in Shanghai this month (September 2023). The facility is also undergoing massive expansion for batteries and EV powertrains, including the production of pouch-type battery cells and ramping up of cylindrical 4680 cells.

- BYD marked the roll-out of its 5 millionth NEV to become the world's first automaker to reach the milestone, achieving it less than 9 months after registering the 3 millionth.

- Volkswagen China and FAW-Volkswagen are jointly investing about $110 million in charging station operator CAMS to accelerate the deployment of charging network.

Green Hydrogen

China is the largest producer and consumer of hydrogen in the world, making about 34 million tons of hydrogen (2021) in one year, although a meagre 0.1 percent is 'green', produced via electrolysis powered by renewable energy. Given the abundance of RE in the country, China is well placed to take the lead in green hydrogen development in the coming years.

According to the World Economic Forum's latest report (June 2023), green hydrogen is playing a pivotal role in helping China realize its strategic ambition to peak carbon emissions by 2030 and become carbon-neutral by 2060. It identifies three main constraints for the expansion of green hydrogen in China – cost, market demand, infrastructure and industry standards and certification.

The country's current H2 production capacity (cumulative) stands at about 220 MW, with 750 MW under construction, according to IEA estimates. Here are some of the recent developments from the country's emerging green hydrogen industry:

- In March 2023, China revealed its green hydrogen development plan as part of its 2060 net-zero ambitions, targeting 50,000 hydrogen fuel-cell electric vehicles on road and production of 100,000–200,000 metric tonnes of green hydrogen per annum by 2025.

- In August, China released national guidelines on hydrogen energy, targeting the introduction of more than 30 national and industry-level standards covering the production, storage, transport and usage of hydrogen energy by 2025.

- Claimed as world's largest green hydrogen project, the Sinopec's 260 MW Kuqa facility in Xinjiang, northwest China with a capacity to deliver 20,000 metric tons per year became operational in June this year.

- Three Gorges Corporation's Inner Mongolia project goes live, targeting 10,000 metric tons per year of green hydrogen output using solar power.

- Sinopec is also working on an a giant green H2 project with 390 MW electrolyser in Inner Mongolia, which will replace the Kuqa project as the world's largest.

To see other articles in this series, click here.